Washington DC

The Best Private Hard Money Lender In Washington DC

ABL has been lending in the District since 2013 and have since become the most reliable hard money lender for Washington DC real estate investments. We provide twelve-month, interest-only bridge loans in DC for financing fix and flips, new construction, cash out/refinances, and rental portfolios. DC has some of the most expensive and competitive urban real estate in the country so local investors need to be smart and act fast, which ABL is ready to help with.

We are private hard money lenders in Washington DC that are control of our own funds, which means we can provide fast (prequalification within 24 hours and loan closing in 7-10 days) financing for your project. We pride ourselves on the local relationships we have cultivated with the best appraisers, attorneys, and title agents in the real estate industry to provide our borrowers the five-star service they deserve.

Flexible Loans in Washington DC for Local Real Estate Investors

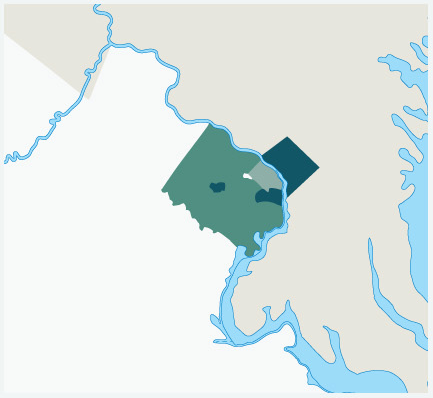

Our team understands the local real estate markets that we lend in, so we’re able to provide expert advice throughout the loan process to help your investment succeed. We fund real estate investments in every neighborhood of DC, allowing investors to freely pick which part of the district they want to focus on.

ABL has been financing successful real estate investments for over a decade, working with experienced investors and first-time investors alike. We offer flexible underwriting that tailors your loan in Washington DC specifically to match your project rather than plugging your investment into a predetermined loan template. With aggressive loan programs loan programs, flexible underwriting, and world-class service, ABL is the premier choice for hard money loans in the District.

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9089. Approval within 24 hours. Our private money loans in Washington DC can help fund your next investment with the following programs:

Hard money loans in Washington DC

Coming Soon.

Success Story

The Most Trusted, Best Private Hard Money Lenders in Washington DC

Financing Your DC Fix And Flip Or New Construction

DC continues to be a steady choice for real estate investments given the nature of the area- population growth and raising wages are consistent, making it a competitive yet reliable market for investing. Fix and flips, as well as new construction, are plugging holes in the inventory shortage and taking advantage of the hot seller’s market. As of December 2020, the average home sale price in DC is $640,650 which is approximately a 2% from the previous year and a slight drop from the 5-year-high from the month before. The number of homes sold throughout December reached 930 which is over 20% increase from the previous year, with homes staying on market for an average of 39 days.

Rental Investments In The District

Asset Based Lending offers term rental loans for 1-4 family properties in Washington DC. These private DC rental loans are highly competitive with rates starting as low as 6.875% and leverage up to 80% LTV. We provide a variety of loan options to benefit our borrowers including 30-year amortization, ARM, and interest-only options. Our flexible underwriting and unique capital structure allows us to offer single rental loans up to $3M and rental portfolio loans in DC up to $3M. With our doc-light approach and five-star customer service, buy and hold investors benefit from these Washington DC rental loans.

The District has always been a hot-spot for rental investments and that continues today. The regular influx of new residents allows for a healthy rental market with the average vacancy rate for 2019 being 5% and over 56% of the population renting rather than owning home. The average monthly rent for the area is $2,063, which is approximately 50% higher than the national average. If you’re an investor that wants to secure their first rental property or are looking for another buy and hold to add to your rental portfolio, Washington DC is a prime location to scout.

Why Choose ABL?

We are Local Private Hard Money Lenders

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.