Reliable Hard Money Lenders In Minnesota

Join thousands of real estate investors across the country that

trust ABL to be their lending partner.

Flips, builds, & rentals

100% construction/rehab financing

Close in 2 weeks or less

Single family, multifamily, mixed-use

Home of the Zero-Point Loan

Light documentation, no tax returns/income verification

Direct balance-sheet lender

Finance Your Minnesota Investment

"*" indicates required fields

The Premier Minnesota Hard Money Lender

Working with Asset Based Lending makes funding your real estate investments easy. As the best hard money lender in Minnesota, we provide investors with fix and flip, new construction, stabilized bridge, and rental property loans. With a fully in-house team for our bridge and term programs, and partnerships with the best local appraisers, attorneys, and titles agents in Minnesota, ABL works with our borrowers to scale their business.

ABL has helped thousands of investors grow their business nationwide. Here’s what you can expect from partnering with ABL’s private lenders in Minnesota:

- Quick closings – as fast as 2 days with appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our private money lenders and Minnesota hard money loans can fund the following projects:

Before coming to ABL I was a real estate agent primarily focused in the Hudson County area for 3 years. I’ve been in the real estate industry my entire life as a painter, wholesaler, agent, & now a loan officer with ABL. My goal is to help you reach your financial goals with real estate investments.

Jeremy is one of the leading Loan Officers for ABL, helping real estate investors finance their projects across fix and flips, new construction, and rental properties.

Scale Up With ABL. Grow Your Minnesota Investments Today.

Why Do Minnesota Investors Choose ABL? The ABL Difference.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

RES. CONSTRUCTION PERMITS ISSUED

UNEMPLOYMENT RATE

Local Information For Minnesota Real Estate Investors

Since the housing market boom of the Covid-19 pandemic has cooled down, the median sale price of single-family homes in Minnesota settled slightly below the national median price in 2022, landing around $325,000. The average number of days on the market for homes in Minnesota has increased from 26 to 34 in 2023, giving buyers more time to find suitable properties for their needs. However, with less than 2 months of inventory there is still considerable competition for buyers in Minnesota’s housing market. With the median sale price reaching $353,000 in June 2023, real estate investors in Minnesota have ample opportunity to find affordable properties for their real estate investments.

Minnesota’s rental market is strong due to the number of universities and large corporations located in the state’s metropolitan areas. Companies like Target and General Mills have headquarters in the Twin Cities area and contribute to the stability of the rental market. These companies combined with the University of Minnesota ensure students, young professionals and young families keep the occupancy rates low for areas like Minneapolis and the surrounding suburbs.

Recommended Cities For Minnesota Real Estate Investing

Asset Based Lending are experts in local Minnesota real estate markets, reviewing trends and shifts to better inform our borrowers while providing the best possible loan terms for each project. Compiling data from Redfin, public town records, and local news sources, we believe some of the best Minnesota neighborhoods for real estate investors are:

Twin Cities Minnesota’s most populous city, or cities, are comprised of Minneapolis and St. Paul. This metropolitan area accounts for 65% of Minnesota’s residents and is the hottest real estate market in the Midwest. The Twin Cities is home to 19 Fortune 500 companies including Target, Best Buy, and General Mills, as well as the University of Minnesota, all of which contribute to the state’s diverse economy and low unemployment rates. As of 2023, approximately half of the city’s residents are renting their home versus owning indicating the strength of the Twin Cities’ rental market, as well as the demand for new single family housing in the area. For investors considering rental market investing, the Twin Cities boasts strong short and long-term rental markets. The tourism industry contributes heavily to the short-term rental market, as the Mall of America, alone, welcomes roughly 40 million people annually from all over the world. With an average home sale price of $432,116 as of June 2023, the Twin Cities are slightly above the national average, making this area perfect place for fix and flip and new construction investors to seek out their next project.

Duluth Minnesota is known as the Land of 10,000 lakes, and the city of Duluth is home to one of the state’s most visited lakes. More than 3.5 million visitors flock to Lake Superior each year, creating a short-term rental market in Duluth that offers great opportunities for vacation rental investors. Along with Lake Superior, Duluth provides residents and tourists with the best of city and country living. Duluth’s economy is driven by one of the largest in-land ports in the country, providing residents with consistent job opportunities, as well as the many picturesque nature activities like Canal Park and the Aerial Lift Bridge. Duluth’s home prices are considerably lower than the Twin Cities, with sale prices at a median of $279,500. For real estate investors looking for properties in Minnesota, Duluth has low cost of entry ensuring easy access for investors attempting to keep initial investment costs low. For investors planning to hold their properties long term and collect monthly cashflow, rent in this city can range from $900 to more than $2,000 a month, depending on location and peak season for short-term rentals.

Rochester A strong economy in Rochester drives this city’s housing market. The Mayo Clinic operates out of Rochester, employing more than 35,000 people in and around this city. As of 2023, there is a $5.6 billion plan in place for the Mayo Clinic to develop Rochester into a Destination Medical Center, which will likely attract doctors, surgeons, researchers, and many other medical professions from across the world to settle in this city. Considering the investments being made in this city, it is prime time for real estate investors to make a move on to any investment projects they are considering in Rochester. As of 2023, the median home sale price in Rochester is $350,000, and each year it grows closer to the national median. Rochester offers real estate investors huge potential for anyone considering tapping into the future of this market.

Recently Funded Fix & Flip Projects

MN Hard Money Loans Are Financing Your Minnesota Fix And Flips

Asset Based Lending is a balance sheet lender specializing in fast financing for fix and flip investors. Our flexible underwriting process means that our borrowers can work on different types of rehab projects simultaneously without running into financing issues. Our expert Loan Officers and Underwriters work together to move as fast as our borrowers, often financing projects in 10 days or less, ensuring that our borrowers don’t miss out on a potential deal. The 12-month interest only loans are perfect for Minnesota investors looking for the market’s most competitive rates, including the industry’s only true zero-point program. ABL offers funding covering up to 85% of purchase price and 100% of the rehab costs. Regardless of experience level, Asset Based Lending is ready to finance your fix and flip. For more information check our Minnesota fix and flip loans.

Why Minnesota Investors Choose Fix And Flips

Fix and flips continue to be one of the most reliable and profitable forms of real estate investing. For fix and flip investors, Minnesota offers the opportunity to expand their portfolio in reliable and affordable ways. In 2022, Minnesota fix and flips accounted for 10% of homes sold across the state, and Minneapolis alone saw some of the country’s largest increases in flipping rates in the same year. With a diverse economy and low unemployment rate, there is a strong demand for housing, especially in metropolitan areas like Minneapolis. Though Minnesota’s housing market is strong, the cost to purchase property is slightly below the national average, allowing fix and flip investors the chance to keep their initial costs low. Minnesota fix and flip investors realized 26.9% profits on their projects in 2022, indicating Minnesota’s high demand for updated homes. When partnering with Asset Based Lending, fix and flip investors in Minnesota can see their profits even quicker. With an average of 10 days to close Asset Based Lending is a premier partner for fix and flip real estate investors, lending in 36 states and growing. Contact ABL today to learn more about our fix and flip loan options.

Using Hard Money Loans For Fix And Flips

Successful fix and flip real estate investors understand the importance of having financing options that are fast and flexible. At Asset Based Lending, making good loans quickly for our investors is always the top priority. With a variety of loans options and some of the industry’s most flexible underwriting processes, we can close loans for borrowers in two days with the appropriate paperwork. We streamline our underwriting process and require only a few documents from our Minnesota investors including recent bank statements and a credit check. We understand the nuances of real estate investing, so we don’t require borrowers to show tax history or income verification. As hard money lenders in MN, we can provide real estate investors with financing options that traditional lenders are not capable of, often partnering with our borrowers on riskier projects that traditional banks would shy away from. Whatever the project type, ALB won’t make the lending process agonizingly long, riddled with loan stipulations such as prepayment penalties or intensive documentation requirements, which often result in a lost deal. For investors in MN looking for fast, efficient lending for fix and flips, hard money loans are the best financing option, and Asset Best Lending is the best financer.

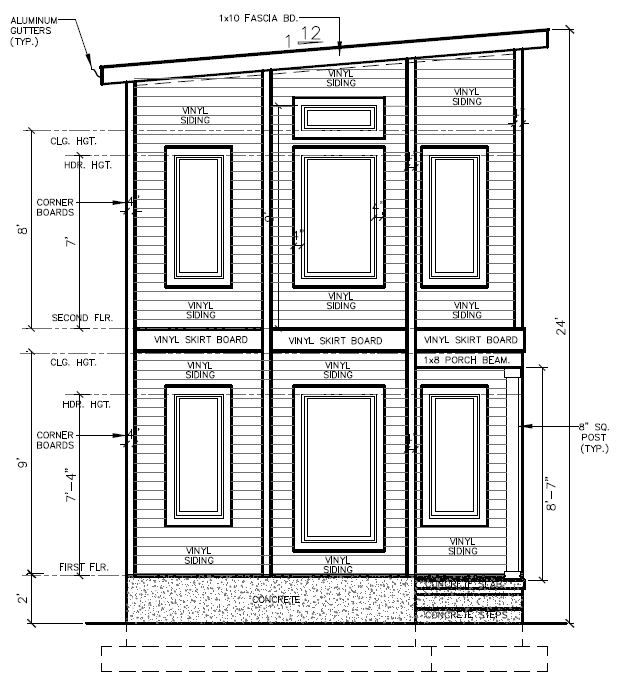

Recently Funded New Construction Projects

Loans For Minnesota New Construction

Asset Based Lending offers creative financing options for ground up new construction real estate projects. With a flexible underwriting process, fast draw turnarounds, and interest rates that are competitive in today’s market, ABL is a premier partner for investors of all experience levels planning their next ground up projects. Each new construction loan is tailored to match the needs of each project, making sure to provide borrowers with the most viable option for their exit strategy. Working with ABL means investors can borrow up to 70% of the land value and 100% of their construction costs, making our loan options ideal for your MN ground up construction investment. To learn more about ABL’s 12-month new construction bridge loan for your single or multifamily construction project, contact one of our qualified loan officers today.

Minnesota New Construction Investment Info

Minnesota’s strong economy contributes to the high demand for affordable housing and is a unique opportunity for investors specializing in new construction projects. In 2023, rising interest rates for borrowers have become a main concern for the state’s ground up construction plans. However, the demand for single family and multifamily homes plays a direct influence on the success investors can realize in this state. Real estate investors in Minnesota face fewer concerns when they work with hard money lenders who offer flexible, 12-month, interest-only construction loans. With loans that finance up to 70% of land purchase and 100% of construction costs, investing in new construction projects in Minnesota with the help of an ABL new construction bridge loan is one way to achieve high returns. As of May 2023, Minnesota has as few as 1.9 months supply of inventory for homes, indicating a strong buyer demand that the market cannot meet. Builders and developers can take advantage of this high demand for housing in Minnesota, while scaling their business through single and multifamily new construction investment. Partner with Asset Based Lending for your next Minnesota new construction project.

Choosing Asset Based Lending For New Construction Loans

Real estate investors who choose Asset Based Lending for their new construction financing consistently rave about how quickly ABL works to close loans. With loan closings happening in as few as 10 days from origination, ABL is one of the industry’s fastest lenders, ensuring our borrowers never miss out on a deal. Providing our borrowers with the ability to scale their real estate investment portfolio means you can act on a ground up construction project, get funded, and take out draws faster than working with other lenders. For investors specializing in single and multifamily new construction, having a lender on your side who is ready to work as fast as you are guarantees you can scale your real estate investment business at your own pace. As a lender run by real estate investors, we understand the importance of a seamless loan process, making it possible for you to focus more on your project, and worry less about your financing. Since ABL is a direct hard money lender with full control of our capital, we can use flexible underwriting to work with investors of all experience levels. Whether you’re ready to start your first new construction project, or are scaling up into multifamily development, Asset Based Lending has a loan option for you.

DSCR Loans for Minnesota Rental Property

Asset Based Lending offers Minnesota rental property investors flexible and reliable DSCR loan options. These loans are designed for investors who buy and hold properties, keeping them in their portfolio to collect monthly income. The DSCR loan covers properties between 1-8 units and even offers options to refinance an entire portfolio. With interest rates starting as low as 6.875% and leverage up to 80% LTV, Asset Based Lending can find creative financing for most rental properties including 30-year amortization, ARM, and interest-only options. ABL provides MN investors numerous possibilities with single rental loans up to $3M, and rental portfolios up to $3M. This program was created for investors of all experience levels, and we assess each deal based on its income-producing viability of the property. For real estate investors who recently completed a rehab project or ground up construction, they can now refinance their projects directly into a long-term DSCR loan, making ABL a one-stop shop for Minnesota real estate investors. Learn more about our rental loan programs here.

Minnesota Rental Markets

In Minnesota, investing in long or short-term rentals can be an effective method to build wealth and scale your real estate investment portfolio. Known as the Land of 10,000 Lakes, Minnesota’s vacation rental market is incredibly profitable as tourist locations like Lake Superior welcome nearly 3.5 million visitors annually. The state’s many unique and picturesque nature attractions offer rental property investors in Minnesota the opportunity to realize monthly rental income up to $2,000 during peak season. Along with being a tourist destination, Minnesota attracts new residents each year looking to contribute to a robust job market. Fortune 500 companies like General Mills have made Minnesota their headquarters, as well as the Mayo Clinic which employs more than 35,000 people in the state. With a diverse job market, and the investments that companies like the Mayo Clinic are making towards the future of the state’s economy, the demand for affordable long-term rentals has grown, offering MN rental property investors many prospects for their next investment. If you’re looking to make Minnesota your next state for rental property investing, contact Asset Based Lending today and discover our flexible loan options.

Hard Money Bridge Loans for Stabilized Property

As the real estate market continues to cool, and interest rates fluctuate, some real estate investors find themselves shifting their exit strategies to adapt to the new market conditions. Asset Based Lending now offers bridge loans for stabilized properties to provide borrowers the flexibility to reposition their investment as they determine the next best steps for their investment. The stabilized bridge loan is designed for investors who recently completed a ground up construction or renovation project, but don’t feel the current market conditions are primed for their exit strategy. Using the stabilized bridge loan means borrowers can hold onto their investment and place tenants to collect market rent while they strategize on their exit plan.

How Do These Stabilized Bridge Loans Work?

ABL offers a 2-year stabilized bridge loan for investors needing extra time for their fix and flip or new construction projects. The 2-year debt service coverage loans bridge financing for up to 24 months with no prepayment penalty, allowing investors to exit the loan whenever they are ready. We offer this financing option for properties up to 20 units, using the lesser of either market rent or leased rent to determine the DSCR and deliver competitive loan terms. The stabilized bridge loans are typically 2-year interest only with rates starting at 10.5% and LTV up to 65%-70%, though these loans are structured to meet individual investor’s needs. If 24 months turns out not to be enough time, we can put this loan on an extension for an additional fee, ensuring that each project is properly financed, and each investor has time to determine their appropriate exit strategy. The loan terms are determined by borrower’s experience, FICO score, and DSCR, using the lesser of either market rent or leased rent to determine your DSCR. If you have a deal that requires temporary bridge financing, then contact us today.