Reliable Hard Money Lenders In Louisiana

Join thousands of real estate investors across the country that

trust ABL to be their lending partner.

Flips, builds, & rentals

100% construction/rehab financing

Close in 2 weeks or less

Single family, multifamily, mixed-use

Home of the Zero-Point Loan

Light documentation, no tax returns/income verification

Direct balance-sheet lender

Finance Your Louisiana Investment

"*" indicates required fields

The Premier Louisiana Hard Money Lender

Working with Asset Based Lending makes funding your real estate investment east by offering borrowers fast and simple hard money loans. We work to provide real estate investors the best hard money, new construction, stabilized bridge, and rental loans. As the best hard money lender in Louisiana, we have a fully in-house team for our bridge and term programs, and partner with the best local appraisers, attorneys, and titles agents in Louisiana.

ABL has helped thousands of investors grow their business nationwide. Here’s what you can expect from partnering with ABL’s private lenders in Louisiana:

- Quick closings – as fast as 2 days with appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our private money lenders and Louisiana hard money loans can fund the following projects:

Before coming to ABL I was a real estate agent primarily focused in the Hudson County area for 3 years. I’ve been in the real estate industry my entire life as a painter, wholesaler, agent, & now a loan officer with ABL. My goal is to help you reach your financial goals with real estate investments.

Jeremy is one of the leading Loan Officers for ABL, helping real estate investors finance their projects across fix and flips, new construction, and rental properties.

Scale Up With ABL. Grow Your Louisiana Investments Today.

Why Do Louisiana Investors Choose ABL? The ABL Difference.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

RES. CONSTRUCTION PERMITS ISSUED

UNEMPLOYMENT RATE

Local Information For Louisiana Real Estate Investors

Louisiana’s real estate market has seen modest growth throughout the years due to the local energy companies and universities that operate out of the major metro areas. Energy companies like Southwestern Electric Power Co., Entergy, and Renewable Energy Group, have all received approval to expand or build new renewable energy facilities around the state of Louisiana in the coming years to meet the state’s growing demand for sustainable energy sources. With these new facilities comes a strong workforce and the need for updated housing. Fix and flips, as in many parts of the country, tend to be the strategy to provide investors the strongest rates of return in LA. The cost of entry to purchase a property in Louisiana is considerably lower than the national average, coming in around $245,000 as of June 2023. For real estate investors in Louisiana, low property prices often mean they will realize an average of 55% return on their investment. Homes typically spend around 46 days on the market before they sell, which is more balanced than the pandemic housing boom for the LA real estate market. Demand is still outpacing supply, indicating that it is still a seller’s market, despite homes being on the market for longer than the national average. For real estate investors looking to Louisiana for a hard money lender for their next project, working with Asset Based Lending means you can close on your next investment in two weeks or less, maximizing your time and money.

Recommended Cities For Louisiana Real Estate Investing

The financing professionals at Asset Based Lending are experts in local Louisiana real estate markets. We review trends and shifts to provide our borrowers with the best possible loan terms on each of their projects. Compiling data from Redfin, public town records, and local new sources, we believe some of the best Louisiana neighborhoods for real estate investors are:

Baton Rouge This is the state’s largest metropolitan area and is situated at the center of the state. Baton Rouge is the political hub of Louisiana and has the strongest job market of all LA’s cities. The local economy is driven by the energy corporations and universities that are headquartered here including ExxonMobil, Turner Industries, and Louisiana State University. The mix of corporate employees and university students and employees means there is a strong demand for single family homes and rental properties within Baton Rouge. The residents of Baton Rouge report 51% renting versus 49% owning their homes, indicating the opportunities for long-term real estate investors. As of June 2023, the median price for a home is $242,000 which is a modest increase from the prior year. The strength of the job market in Baton Rouge means the city has an unemployment rate of around 4%, an attractive statistic for investors looking to Baton Rouge for their next project. Investors interested in Baton Rouge for the next fix and flip, or rental property can easily secure properties with the low purchase prices and demand for updated housing in this city.

New Orleans Mardi Gras alone draws thousands of people each year to New Orleans. For the 2023 parades, an estimated 225,000 people attended, 41% of whom traveled from out of state. The Mardi Gras tourists brought with them nearly $20 million in revenue for the state. As the largest tourist destination in Louisiana, New Orleans’s economy is heavily dependent on visitors from out of state and tourism accounts for approximately two fifths of the state’s tax revenue. Real estate in New Orleans tends to be the most expensive with a median sale price of $360,000, resulting in 52% renting their homes versus owning. Along with tourism, New Orleans also plays host to several military bases including Naval Air Station Joint Reserve Base in New Orleans, as well as universities such as Tulane, Loyola, Dillard University, the University of Holy Cross, among many others. These factors combined make New Orleans ripe for the rental market. Rental property owners benefit from the military personnel that are stationed in and around the city, while short term rental properties capture the tourist market.

Shreveport Another Louisiana city with a strong military presence is Shreveport. Barksdale Air Force Base is in Shreveport and services approximately 15,000 people from active duty and their families to civilian employees and retirees. Considering the number of residents that are stationed in Shreveport, there is a high demand for quality rental properties. Home prices remain affordable in Shreveport with a median price of $185,000, making it a great place for investors who intend to hold rehabilitated properties in their portfolio and rent them to collect monthly income. Nearly 53% of residents in Shreveport own their home while 47% are renting. While there is a strong rental market, Shreveport residents are also searching for single-family homes. The current market is not meeting the demand for single-family housing, leaving an opportunity for investors specializing in new construction projects.

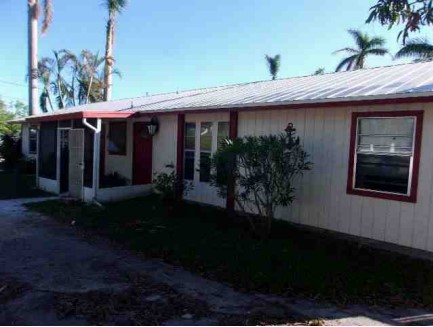

Recently Funded Fix & Flip Projects

LA Hard Money Loans Are Financing Your Louisiana Fix And Flips

Investors who choose Asset Based Lending for their fix and flip financing are met with the necessary level of urgency required for them to land a deal quickly. Our flexible underwriting means investors can take on more projects than with traditional financing methods, making your portfolio grow and your business scale up as quickly as you can. With deals closing in and an average of 10 days or less, you’ll never miss out on a potential deal. These 12-month, no-interest bridge loans allow Louisiana fix and flip investors to get their projects off the ground with the most competitive rates on the market, including the industry’s only true zero-point program. ABL offers funding that covers up to 85% of purchase price and 100% of rehab costs. For new investors, or seasoned fix and flip professionals, Asset Based Lending has loan options for you. Click to learn more about our Louisiana fix and flip loans.

Why Louisiana Investors Choose Fix And Flips

For real estate investors in Louisiana the opportunities for fix and flip projects are plentiful. Across the state median home sale prices fall well below the national average, around $245,000, allowing more investors access to the market. The average rate of return for fix and flip investors in LA is around 55.6% which translates to approximately $38,000 per project. Although the return for flipping in other locations around the country can be much higher, for investors in LA purchasing properties at significantly lower costs, this is a healthy profit. Having the cost of entry lower than in other locations also means investors can more easily implement the new construction codes mandated by the state, including properly weatherizing roofs to protect homes against extreme rain and hurricanes. Using ABL’s fix and flip loans for projects in Louisiana gives investors the opportunity to close deals in 10 days or less, exit them quickly, and reinvest their profits into the next fix and flip project.

Using Hard Money Loans For Fix And Flips

In today’s real estate market, investors need to act quickly to land the best deals to build their portfolio and scale their real estate investment business. Working with ABL to finance fix and flip loans means that investors have a lending partner who understands the urgency of getting to the closing table, something ABL has accomplished in as few as two days with the appropriate paperwork. Our loan originators and underwriting teams work together to find solutions to best fit our investor’s needs, always being flexible to reach the desired results expeditiously, and ensuring deals are landed. Hard money loans with ABL are less rigorous than working with other lenders, requiring fewer documents, and foregoing things like years of tax records and income verification. Our document light approach requires the basics like ID, recent bank statements, and credit check, effectively easing the process for our investors. For fast and efficient lending there is no better hard money lender than Asset Based Lending.

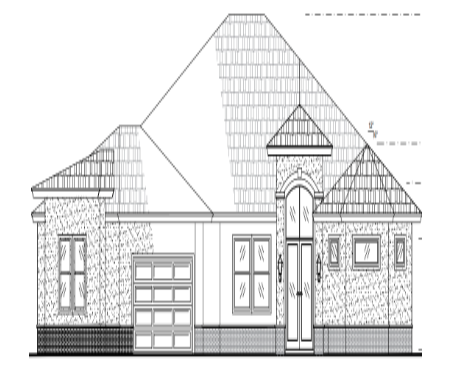

Recently Funded New Construction Projects

Loans For Louisiana New Construction

Asset Based Lending offers 12-month, interest-only new construction loans for real estate investors seeking competitive interest rates, fast draw turnarounds, and flexible underwriting. Louisiana real estate investors with experience, or new to the industry, as well as builders and developers, can borrow up to 70% of the land value and 100% of the construction costs. Our ground up construction loans are tailored to fit the needs of our borrowers and are structured to ensure they receive the best loan terms for their preferred investment strategy. Each deal is assessed for its unique qualifications, and we evaluate the experience level of each investor to ensure that all parties are benefiting from each project. To learn more about our new construction loans, and how you can get your single or multifamily projects off the ground, contact ABL to discuss the opportunities available to you.

Louisiana New Construction Investment Info

In 2023 the local government in Louisiana has approved several initiatives to help safeguard newly constructed homes against the impact of extreme weather events like hurricanes. These initiatives include updating the existing construction code for methods of roof installations as well as requiring more ground fault circuit interrupter outlets throughout homes, among other building code updates. The Department of Energy is slated to receive $1.6 million at the end of 2023 to implement these changes and build more energy efficient homes across the state. Over time the code updates will save around $422 annually per household, and lead to 6,100 new construction jobs across the state. With these changes Louisiana expects insurance companies to release the pauses they have put on covering properties and limit the premiums homeowners and investors currently pay for coverage in the state. Though new construction in the state has been limited in recent years, the expectation is that it will start to pick up again once the new code regulations are implemented and homeowners’ insurance is more accessible and affordable to investors in Louisiana. Considering the demand for new construction homes in Louisiana significantly outweighs the supply, builders and developers can take advantage of the market conditions by filling these gaps in the housing market. To learn more about ABL’s New Construction loans contact us today.

Choosing Asset Based Lending For LA New Construction Loans

New construction projects require planning and coordination to guarantee timelines are met, and working with a lender that does not meet the requirement to move quickly often means borrowers are unable to close, or even complete their deals. Funding your new construction projects with Asset Based Lending ensures that deals are not only closed quickly, but also funded quickly for each stage of construction. Our investor-friendly terms make it possible for real estate investors, builders, and developers to leverage ABL’s new construction loans and control more of the market share in their target markets. Unlike the slow turnarounds and lengthy draw processes that most traditional real estate investor financing provides, ABL prioritizes speed and efficiency when funding draw stages for our investors. With guidelines that are less strict than other banks and private money lenders, ABL’s borrowers can spend more time tending to their jobsite and less time tracking down paperwork and waiting for inspections to move through their new construction projects, ultimately resulting in more scalability. Reach out to ABL today to learn more about our flexible underwriting process for new construction loans and get your Louisiana started.

DSCR Loans for Louisiana Rental Property

For Louisiana real estate investors interested in the buy and hold long-term real estate investment strategy, Asset Based Lending offers simple and reliable DSCR rental loans options. These DSCR term loans cater to deals featuring properties between 1-8 units, or investors looking to refinancing an entire real estate portfolio. With a variety of flexible rental loans options including 30-year amortization, ARM, and interest-only options, Louisiana investors can find the perfect loan for their investment strategies. Regardless of experience level, ABL works together with our borrowers to assess each deal based on the income-producing viability of the property to give our borrowers the best options for their goals. ABL’s DSCR rental loan program offers borrowers competitive rates starting as low as 6.875% and leverage up to 80% and can be used for single rental loans up to $3M, and rental portfolios up to $3M. For investors who worked with ABL for bridge loans to finance their ground up construction or fix and flip projects can refinance their projects directly into a DSCR loan, making ABL your one-stop shop for Louisiana real estate investors. Click here for more information about Asset Based Lending’s DSCR rental loan options.

Louisiana Rental Markets

Louisiana’s economy is heavily reliant on the tourism industry as well as the oil and gas industry that operates in cities like Baton Rouge. With this dependency on visitors from out of state spending time in places like New Orleans it’s no surprise that Louisiana has a strong short-term rental market. In New Orleans alone there are 4,921 active and licensed Airbnb’s as of March 2023. In 2019 Louisiana started implementing some restrictions on short-term rental property operators requiring them to be approved for licenses for each property, as well as limiting the number of STR properties in a square block. Although investors must abide by the states STR regulations, once all appropriate steps have been taken STR operators can stand to make upwards of $250 a night for a single rented property in locations like the French Quarter, indicating the strength of the market and the demand for tourist rentals. Long-term rental property investors can also realize profits in cities like Baton Rouge and Shreveport. Baton Rouge is the political and business capital of the state and many young professionals living in this city prefer the flexibility of renting modern, luxury apartments. Rental properties in Baton Rouge saw a 4.2% increase in rent prices from 2022 to 2023, bringing the average cost to rent up to $1,219, and New Orleans experienced similar increases and the average cost to rent an apartment is up to $1,357. When Louisiana real estate investors find the right property and location, investing in rental property can be a great addition to their investment portfolio and add to their monthly income. If you’re ready to finance your Louisiana rental property investment and grow your portfolio using fast and flexible loan options, contact Asset Based Lending to get started.

Hard Money Bridge Loans for Stabilized Property

Considering the changes that the real estate market is experiencing, from increasing interest rates to the post-Covid property pricing corrections, investors often find themselves waiting for the right conditions to sell their fix and flip or ground up new construction projects. Using ABL’s stabilized bridge loans means Louisiana investors can make the right decision for their investment goals without sacrificing profits. The stabilized bridge loans are designed for investors that recently completed their ground up new construction or fix and flip projects and have made the decision to hold on to their investment until the market presents more favorable conditions. This 2-year DSCR loan can also work well for the investor searching for a turnkey rental property to add to their portfolio for a few years before they eventually sell or refinance when mortgage rates are more advantageous. If you’re looking to bridge the gap on any of your investment properties, find out more about ABL’s stabilized bridge loans.

How Do These Stabilized Bridge Loans Work?

The 2-year debt service coverage loans to investors to help bridge their financing for up to 24 months with no prepayment penalty. ABL’s stabilized financing options apply to properties up to 20 units, using the lesser of either market rent or leased rent to determine the DSCR and deliver borrowers with competitive terms. Our flexible underwriting process allows us to structure each stabilized bridge loan to meet each investor’s needs. The typical bridge loan is 2-year, interest only, with rates starting at 10.5% and LTV up to 65%-70%. Loan terms are determined based on factors like experience level, FICO score, and DSCR, using the lesser of either market rent or leased rent to determine your DSCR. Borrowers also have the option to extend their bridge loan for an additional fee if the 2-year term is not enough time for investors to meet their investing goals. If your investment project needs a bit more time and can benefit from temporary bridge financing, contact ABL today.