Virginia

The Premier Hard Money Lender In Virginia

Asset Based Lending has been offering private hard money loans for over a decade, providing real estate investors in Virginia with the most reliable financing in the industry. We specialize in closing deals quickly, with loan approval occurring as fast as 24 hours and initial funding in 10 days or less. ABL’s flexible underwriting allows funding for a wide variety of real estate investment projects, including fix and flips, new construction, cash out/refinances, and rental portfolios.

As hard money lenders in Virginia, we have full control of our funds, which means we can provide fast and flexible financing to qualified investors. ABL partners with the best local appraisers, attorneys, and title agents in the real estate industry to provide our borrowers a five-star experience during the entire loan process.

Hard Money Loans For Local Virginia Real Estate

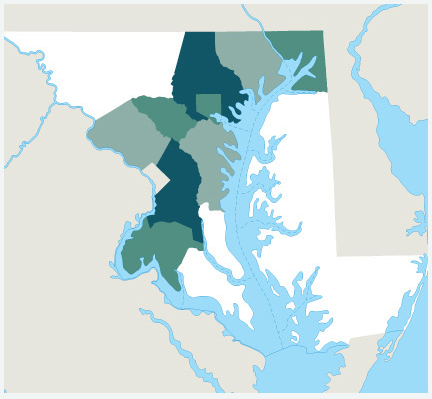

Our team of hard money lenders in VA specializes in lending throughout Northern Virgina and are experts in the local real estate markets, understanding that a hard money loan in Fairfax County needs to be written and funded differently than one in Arlington County. We treat each project as unique and use in-house processing and underwriting to provide the most competitive rates and quickest closing times possible.

Whether you’re a first-time investor or have decades of experience, ABL’s private money lenders in Virginia are willing to listen to your project details and determine if we can fund your investment. With unmatched speed, service, and transparency, ABL is the premier choice for hard money loans in Virginia.

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9089. We approve loans as fast as 24 hours. Our private money loans can fund the following projects:

Anne Arundel, Baltimore, Baltimore City, Cecil, Charles, Harford, Howard, Montgomery, Prince George

Seth has been involved in private capital industries for 20 years, becoming an expert in finance and lending. For the last 7 years, he has been helping real estate investors finance their projects, with a strong focus on speedy closings. Seth specializes in building strong relationships, analyzing deals, and quickly determining suitability for his clients.

Coming Soon.

The Best Hard Money Loans In Virginia

Fix And Flip Financing Done Right

Investors who can spot a distressed property and transform it into a gorgeous, sale-ready home are able to take advantage of the current hot seller’s market. The main issue preventing most investors from their next project is lack of capital. Asset Based Lending’s fix and flip loans are industry-leading, offering fast closing speeds and flexible underwriting on 12-month, interest-only hard money loans for fix and flip real estate investments.

We can close deals as quickly as three days if all the paperwork is ready, and our average closing time is just 10 days. These hard money fix and flip loans cover up to 90% of the purchase price and 100% of the rehab costs. For more information, such as rates and requirements, check out our additional details on Virginia fix and flip loans.

Loans For New Construction

Flexible underwriting and fast closing speed are essential components of profitability in a competitive real estate market, especially for new construction projects. ABL offers hard money loans for new construction in Virginia with the same quickness and reliability as our fix and flip loans. These new construction loans are only available for experienced investors, contractors and builders, who typically can borrow up to 90% of the land value and 100% of the construction costs.

ABL understands the construction market within our lending areas, so we offer the hard money loans that Virginia builders require. Quick approvals and closings, an in-house draw management team that reimburses construction funds as quickly as possible, and a flexible staff that works with you to ensure your project goes off without a hitch. Since we’re direct Virginia hard money lenders lending our own money, you can rest assured we’re invested in making sure we make good loans to smart investors on projects that will be profitable for everyone.

Rental Loans

Asset Based Lending offers term rental loans for buy and hold investors in Virginia. These private rental loans are for 1-4 family properties and are designed with buy and hold investors in mind. We offer rates starting as low as 5% with leverage up to 80% LTV. Our unique capital structure allows us to provide single rental loans up to $3M and rental portfolio loans up to $3M.

ABL offers a variety of loan options to match borrower needs including 30-year amortization, ARM, and interest-only options. We work with investors of all experience levels, whether you’re expanding your current rental portfolio or want to secure your first rental property. Our team are experts in the local real estate markets of Virginia and are focused on delivering a five-star experience for our borrowers. If you’re ready to grow your real estate business with out VA rental loans, then contact us today.

Why Choose ABL?

We are Local Private Hard Money Lenders

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.