Florida

Fix and Flip, New Construction Loans, Cash Out/Refinance in Florida

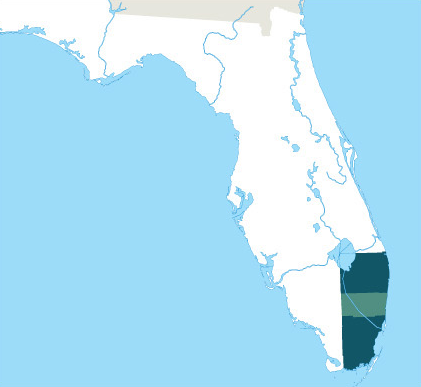

Asset Based Lending, LLC (ABL) should be your first choice when it comes to private, hard money lenders in Florida. As a direct lender, we have been working with Florida real estate investors in Broward, Dade, and Palm Beach counties for years. However, as of 2017, we’re proud to be able to offer our quick-close hard money lending services to the entire state. If you’re searching for hard money loans for first time flippers or experienced investors, you’ll find them right here.

Our Florida hard money lenders provide 12-month, interest-only bridge financing for the following programs: Fix and Flip, New Construction, and Cash Out/Refinance. We also offer term rental loans for buy and hold investors in Florida.

The Best Private Hard Money Lenders in Florida

We provide asset-based loans to beginners and experienced investors for non-owner-occupied residential real estate that is being purchased, renovated and rehabbed. For experienced investors, ABL offers competitive hard money loans for new construction.

Our reputation on the east coast, coupled with the local relationships we have established in the state, ABL can arm you with a real estate team of community businesses to support your project. ABL’s programs for hard money will help ensure your financing is available how and when you need it.

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9089. Preliminary approval within 24 hours. Let our hard money loans in Florida help you get started on your next project:

ABL Lends In All Counties In Florida

Paul Lewis brings with him a wealth of knowledge in the world of specialty finance, especially alternative financing in the Florida market. In his career, he has closed in excess of $200M in commercial bridge financing, and north of $100M in specialty factoring. A native New Yorker, Paul has lived and worked in Florida for almost 10 years.

Mailena Garcia joined the ABL team in 2021 as a Loan Officer to help manage the firm’s growth in the Florida market. Her previous experience includes several years in leasing and property management where she discovered her passion for the real estate business and became an expert on industry details. She is fluent in both English and Spanish, allowing her to communicate with borrowers in their preferred language. Mailena has been a Florida native for most of her life: she was born in Cuba and moved to Florida when she was 9 years old, residing in Jacksonville to this day. When she is not at work, she enjoys traveling and reading.

Recently Funded Florida Hard Money Loans

Market Highlights For FL Real Estate Investors

NUMBER OF FIX & FLIPS

22,843

AVERAGE FIX & FLIP GROSS REVENUE

AVERAGE ROI

AVERAGE RESALE PRICE

NUMBER OF HOMES SOLD

AVERAGE DAYS ON MARKET

Quick Close Hard Money Loans

Fast Fix And Flip Financing

Fix and flip investments can be extremely profitable for real estate investors. As private hard money lenders in Florida specializing in fix and flip loans, ABL’s primary focus is providing fast and reliable access to capital for our investors.

It takes talent to be able to spot a problem property and envision a renovated, sale-ready home. It also takes money to acquire the property and do the work. We primarily provide 12 month loans to both first time and experienced investors. In a state where home values and population are increasing, and time on market is decreasing, investing in real estate is a smart and savvy strategy.

Whether you’re a new investor or have done multiple deals, ABL has assembled a fix and flip guide for the state of Florida that breaks down investing in the sunshine state and ensures the right path forward.

Access to quick, reliable funding is critical to the success of any fix and flip deal. In a hot market, having the ability to close quickly gives investors a distinct advantage in the purchasing market. ABL provides financing solutions that typical lenders cannot. We can close in as few as three days and our average closing time is 10 days.

ABL has close relationships with many borrowers who invest in some of the top fix and flip cities in the state. Our investors can rely on us to cover up to 85% of purchase price and 100 percent of rehab costs so they can focus on what really matters- flipping their property for a profit!

New Construction

ABL is extremely active funding new construction projects with hard money loans in Florida. When conventional financing is not the right answer for a project, experienced investors, contractors and builders can trust us as a top hard money lender to fund 70% of the land value and 100 percent of construction costs.

Our underwriting criteria is flexible, however, we won’t fund a loan if a borrower’s experience doesn’t convince us that everyone involved in the deal will profit. We’re happy to discuss your project to see if you qualify for our hard money construction loans in Florida..

Flexible Rental Loan Options

Asset Based Lending is proud to offer term rental loans for Florida real estate investors. These private rental loans provide funding for buy and hold investors that want to begin or expand their rental investment portfolio. We offer rental property financing for 1-4 family properties with a wide range of loan options including 30-year amortizing, ARM, or interest-only options. Our team works with investors of all experience levels, assessing the deal based on the income-producing viability of the property.

These loans are designed for investors following the BRRRR strategy: buy, rehab, rent, refinance, repeat. By using ABL to fund your initial purchase and rehab, you can grow your rental portfolio much faster and begin generating your passive monthly income sooner than later. Our unique capital structure allows us to offer the most competitive loans, with rates as low as 5% and leverage up to 80% LTV. If you’re a BRRRR investor looking for Florida rental loans, contact us today.

Top Hard Money Lender in the State of Florida

ABL selectively chooses to lend in 7 states that we know can be profitable for both us and our borrowers.

As private money lenders in Florida, we expanded our loan programs from previously only servicing south Florida to now, the entire state. Our research and evaluation processes are extensive. We only decide to lend in areas that are prime locations for real estate investments and we can proudly say that Florida is one of the best!

Because we are a regional lender and knowledgeable about the areas we lend in, borrowers can trust our loan officers and underwriting team to assist them in identifying good deals and avoiding bad ones.

We Know The Local Florida Markets

The ABL team are experts in the local real estate markets that we lend in, identifying opportunities to better serve our borrowers with insight on what makes a successful deal in these areas. With the state experiencing record-low inventory and a booming market that favors the home seller, putting together your investment strategy is more important than ever. Based on internal and external data, we have identified some of the top Florida real estate markets for investors: Jacksonville, Miami, Orlando, and Tampa. Whether it’s their thriving job markets or cultural significance, these cities are delivering high ROI for fix and flips, new construction projects, and buy and hold rental property. If you’re an investor that wants to take advantage of these opportunities with our hard money loans, contact us today.

Why Choose ABL?

We are Local Private Hard Money Lenders

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.