Massachusetts

Fix and Flip, New Construction, Cash Out/Refinance

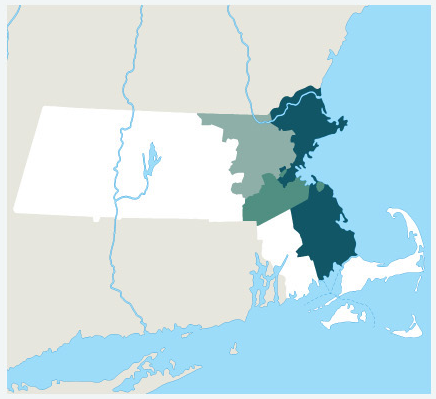

Asset Based Lending, LLC (ABL) is a private, hard money lending company primarily servicing the Boston Metropolitan area. As a direct lender, we work with real estate investors in eastern Massachusetts, and are currently lending in Suffolk, Norfolk, Essex, Middlesex, and Plymouth counties. Our experience and capabilities make us one of the best hard money lenders in MA.

We provide 12-month, interest-only bridge financing for the following programs: Fix and Flip, New Construction, and Cash Out/Refinance. For buy and hold investors in Massachusetts, we offer term rental loans.

Private Money Lenders In Massachusetts

At ABL, we provide asset-based loans to beginners and experienced investors for non-owner-occupied residential real estate that is being purchased, renovated and rehabbed. In addition, ABL offers competitive New Construction loans to experienced investors.

With a dedicated loan officer servicing the state of MA, coupled with the local relationships we have established with service providers in your area, ABL can arm you with a real estate team of community businesses to support your project. Whether you’re in Boston, Springfield, or somewhere in between, ABL is ready to finance your real estate investment with our hard money loans in MA.

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9089. Preliminary approval within 24 hours. Get started on your next project with the best source for Massachusetts hard money loans:

ABL Lends in:

Suffolk, Norfolk, Essex, Middlesex, Plymouth

Michael Chadwick joined Asset Based Lending as a Vice President and Area Manager in December 2020, bringing with him over 20 years of real estate and financial services experience in the New England area. Prior to ABL, Michael was responsible for developing and directing the day to day operations for a private lender in the north east where he led the origination and underwriting of over $150 million in loans across 5 states. In addition to Michael’s hard money lending and commercial finance background, Michael has hands on experience as a real estate investor having led a private investment firm through the acquisition and renovation of approximately 150 homes throughout New England.

Michael is an expert in managing hard money loans for real estate, with experience in assets ranging from single-family fix and flips to 7-figure multi-family new construction projects and everything in between. His skillset spans many aspects of real estate lending including underwriting, property valuation and analysis, and even construction draw management. His dedication and personal touch have cultivated strong business relationships with his borrowers throughout the years, meshing perfectly with ABL’s lending culture.

Fast Fix And Flip Financing

It takes talent to be able to spot a problem property and envision how to transform it into a beautiful, sale-ready home. It also takes money to acquire the property and do the rehab work. Home fix and flip loans are the link to profitability and leverage in this scenario, and these real estate investor loans have always been a primary focus for ABL. As hard money lenders in Massachusetts, we primarily provide 12-month loans to experienced investors and professionals, but we do lend to qualified first-time borrowers as well.

Speed is critical to capitalizing on incredible investment property opportunities in Massachusetts, and ABL provides financing solutions that typical lending institutions cannot. We can close in three to four days if all of the paperwork is in order, and the average closing time is 10 days for our fast MA hard money loans — which cover up to 85% of the purchase price and 100 percent of the rehab costs. Click here for more details about rates and requirements for home fix and flip loans.

New Construction

Seasonal and market conditions can dictate a need for quick and flexible underwriting for new construction as well. ABL provides new construction loans in MA when conventional financing is not the right answer. New construction loans in Massachusetts are available only to experienced investors, contractors and builders, who typically can borrow up to 70% of the land value and 100 percent of the construction costs.

While our underwriting criteria for construction loans are flexible, with no minimum credit score requirements, borrowers can be sure of our faith in them because we won’t fund a loan if our experience doesn’t convince us that everyone involved in the deal will profit. Click here for more details about rates and requirements for these 12-month new construction loans.

Rental Loans

Asset Based Lending offers term rental loans for buy and hold investors in Massachusetts. These private rental loans are designed for 1-4 family properties with single rental loans up to $3M and rental portfolio loans up to $3M. Our unique capital structure allows us to offer competitive loans with rates as low as 6.875% and leverage up to to 80% LTV.

ABL offers flexible loan options to help meet borrower needs, including 30-year amortization, ARM, and interest-only options. We work with investors of all experience levels, whether you’re working on your first rental property or expanding your rental portfolio. Our team is dedicated to providing a five-star service for our borrowers by partnering with the best local appraisers, title agents, and attorneys. If you’re ready to grow your real estate business with these MA rental loans, then contact us today.

Your Local Massachusetts Private Money Lender

Over ten years of success in the northeast has made ABL experts in the local real estate markets for Massachusetts. We follow market trends in the areas we lend in to better serve our borrowers and ensure we deliver our five-star service every time. Based on internal and external data, ABL has identified two cities as an opportunity for investors: Springfield and Boston. Both cities have seen a boost to their real estate markets in recent years, thanks to their cultural significance, growing job markets, and convenient location near other major cities of the northeast. Savvy investors can take advantage of this by working with a lender that understands what makes a viable property in these local markets. If you’re an investor that wants to use our hard money loans to invest in Boston and other areas in Massachusetts, contact us today.

Why Choose ABL?

We are Local Private Hard Money Lenders

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.