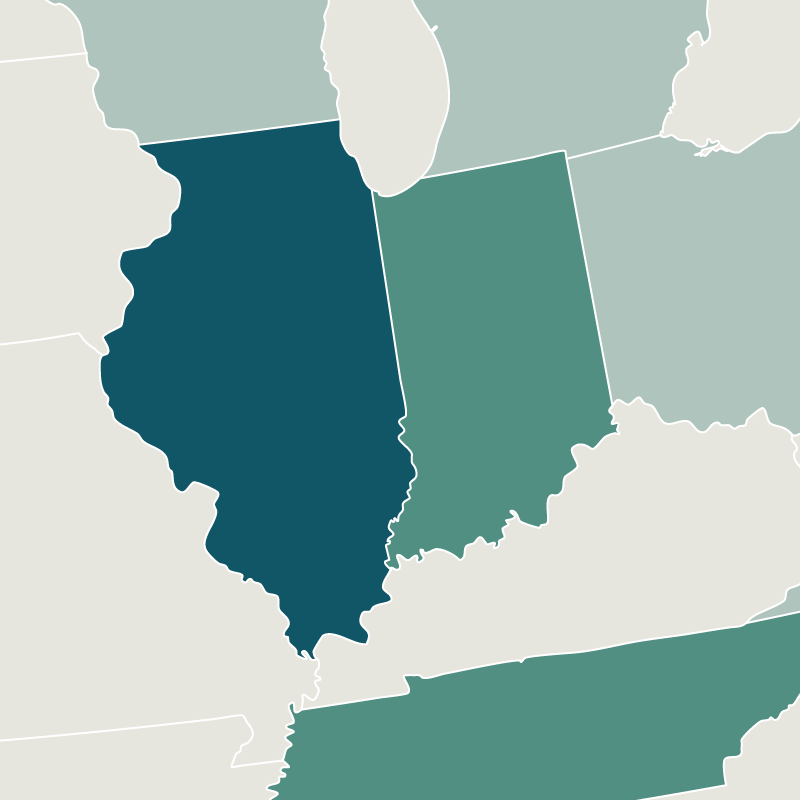

Illinois

Fix and Flip, New Construction, & Rental Property Financing In Illinois

Asset Based Lending is proud to finance Illinois real estate investors on a variety of project types including fix and flips, new construction, cash out refinances, and buy-and-hold rental property. With over twelve years of lending experience and over $2B in loan originations, our loan programs are designed for investors to scale their real estate business quickly and efficiently. We close loans in an average of ten days and offer loan approval as fast as 24 hours, helping our borrowers remain competitive in the market and secure projects that they might have previously missed out on.

As direct lenders in full control of our capital, ABL is able to offer flexible hard money loans that are written to match your business plan. Whether you’re looking for maximum leverage, lower interest rate, zero points, or something else, our team can work with you on your deal to ensure you receive the best possible loan. Our team are experts in local Illinois real estate markets, understanding that a rental property investment in Chicago needs to be handled differently than a fix and flip in Aurora. Each loan program has its own lending criteria, but every loan is serviced fully in-house to guarantee a five star experience from start to finish. If you’re looking for a reliable lending partner on your upcoming real estate investment, then contact us today to discuss how ABL can finance your next success.

The Best Private Hard Money Lenders in Illinois

Asset Based Lending first started as a local hard money lender in New Jersey back in 2010. Over 12 years and $2B in deals funded later, ABL has become the premier hard money lender for real estate investors in Illinois and beyond. Our team partners with the best title agents, appraisers, and attorneys in the Prairie State to ensure our borrowers have a smooth loan process from their first phone call to their final loan payoff. As your financial partners on these deals, we’re invested in your success and are available to help you every step of the way.

ABL specializes in flexible loans and fast closings, tailoring your loan to match your specific project and closing deals in less than two weeks on average. We use a doc light approach to hard money lending, meaning we don’t require proof of income or other intensive financial documentation- just credit score and proof of liquidity are all we need to start approving your loan. With a fast and transparent loan process that’s led to hundreds of five-star reviews, its no wonder why more than half of our borrowers return for repeat business. Whether you’re practicing the BRRRR strategy in Chicago or are working on a fix and flip in Joliet, ABL is dedicated to providing the most reliable loans for real estate investors. Contact us today if you’re ready to be approved for the best Illinois hard money loans.

Prequalify Today

Get approved for your next project, or learn more about our various loan programs below:

Coming Soon.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

TOTAL FIX AND FLIPS

AVG FIX AND FLIP PROFIT

POPULATION GROWTH

HOMES SOLD

Recently Funded Projects

Reliable & Fast Fix and Flip Loans

Asset Based Lending is the best lender for fix and flips, specializing in closing deals quickly and providing flexible loan options to help investors maximize their earning potential. These 12-month interest only bridge loans are designed to close in ten business days and allow borrowers to fund up to 90% of the property purchase and 100% of the renovation costs of the project. ABL flip loans are meant to help our borrowers fund the purchase and rehab of the property and use the profits to pay off the loan quickly with no prepayment penalty so they can move on to their next project.

As investors ourselves, we understand what fix and flip loans require from a borrower perspective. Since our focus is on the asset, we’re able to work with investors of all experience levels, whether you’re working on your first fix and flip in Aurora or you’re looking to scale our Chicago fix and flip business. Our loans scale alongside you, so the more fix and flips you do the better terms we can provide on subsequent deals, ensuring that you benefit by partnering with us on multiple deals. ABL uses flexible underwriting to make sure you receive the best possible loan for your project, with options such as zero points, maximum leverage, lowest interest rate, or something else that fits your exit strategy. If you’re ready to use the best fix and flip loans IL has to offer, than contact us today.

Hard Money Loans For New Construction

Illinois is currently lagging behind the majority of states when it comes to residential new construction, with Chicago being one of the most underbuilt metro areas in the country. As of May 2021 there’s been a 15% decrease year over year in newly listed homes, highlighting the lack of available inventory across the entire state. With only a two month supply available and a minimum of three month supply needed to qualify as a healthy market, the new construction investors have a chance to fill these inventory slots and receive a healthy profit after selling.

ABL works with experienced builders and developers by providing hard money new construction loans that finance up to 90% of the land value and 100% of construction costs. These new construction loans provide fast and flexible financing to experienced builders and developers looking to scale their real estate business. These bridge loans are designed to close quickly and provide the capital needed for new construction projects to to be acquired, completed, and sold in one streamlined process. If you’re looking for Illinois new construction loans that can help you grow your real estate business, then contact us today.

Rental Loans For Illinois Real Estate Investors

Investing in rental property has become one of the most popular and accessible real estate investments, as it has a lower barrier to entry cost and is achievable for investors of all experience levels. Asset Based Lending provides simple and reliable rental loans that allows real estate investors to buy and hold properties across popular Illinois markets. Our rental loans start as low as 6.875% with leverage up to 80% and a variety of options to match your investment strategy. We provide rental loans for properties between 1-8 units across different housing types such as multifamily, condos, townhomes, single apartments, etc. ABL can work with you around your investment strategy to ensure that you receive a rental loan that matches your business plan.

These rental loans are designed for investors utilizing the BRRRR strategy, whether you’re just starting out with your first rental property or you have a current portfolio that you’re looking to expand. With a single loan cap of $3M and portfolio loan cap of $3M, we can help investors who are at different points of their investment business. ABL rental loans can be used for various lease lengths as well, meaning investors could use these as Airbnb loans if that matches their end goal. If you’re ready to grow your real estate business with our Illinois rental loans, and our Chicago hard money loans, contact us today.

Why Choose ABL?

We are Local Private Hard Money Lenders

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.