Oklahoma

The Premier Oklahoma Hard Money Lender

Hard money loans don’t have to be difficult- that’s why Asset Based Lending specializes in fast and reliable financing for real estate investors. We provide bridge loans for fix and flips and new construction investments, as well as cash out refinances and loans for rental property. With loan approval as quickly as 24 hours and the ability to close loans in 10 days or less, ABL’s lending programs are designed to help real estate investors scale their business quickly. ABL uses a fully in-house team across our underwriting, processing, closing, and draw management teams so we can ensure a five-star experience from start to finish. Our team boasts over a decade of loan experience and thousands of projects funded totaling $2B, highlighted by our hundreds of five-star reviews. After you experience the ABL Difference, you’ll never use another hard money lender.

- Quick closings – as fast as 2 days with appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one-stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans in OK as fast as 24 hours. Our Oklahoma private money loans can fund the following projects:

Seth has been involved in private capital industries for 20 years, becoming an expert in finance and lending. For the last 7 years, he has been helping real estate investors finance their projects, with a strong focus on speedy closings. Seth specializes in building strong relationships, analyzing deals, and quickly determining suitability for his clients.

Coming Soon.

Experience The ABL Difference

See why thousands of local real estate investors trust ABL to be their real estate financing partner.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

RES. CONSTRUCTION PERMITS ISSUED

UNEMPLOYMENT RATE

Local Information For Oklahoma Real Estate Investors

Oklahoma real estate has seen substantial growth, with its biggest metro areas growing exponentially over the last few years. As of September 2022 the state’s average home sale price reached $238,600 which is a 10% increase from the previous year and just shy of the five-year-high for the state. Homes are spending an average of 16 days on market, and about 32% of homes are selling above asking price, which highlights the competitive nature of Oklahoma real estate markets. There are currently 13,035 homes for sale which represents approximately a two months supply of homes available in the state, which explains the fast moving market given the high demand compared to low inventory. Builders and contractors could take advantage of this inventory gap with new construction investments, as well as fix and flip investors who benefit from the state’s rapid home sales.

Recommended Areas For Oklahoma Real Estate Investing

Asset Based Lending are experts in local Oklahoma real estate markets, reviewing trends and shifts to better inform our borrowers while providing the best possible loan terms for each project. Compiling data from Redfin, public town records, and local news sources, we believe some of the best areas to invest in Oklahoma real estate are:

Oklahoma City The largest city in the state is also one of the best spots to invest in OK real estate, The average home sale price reached $255,000 which is a nearly 9% increase year over year and just slightly below a 5-year-high for the area. Homes are spending only 13 days on market, which benefit fast moving investments such as fix and flips. The economy revolves around oil, natural gas, and one of the world’s largest livestock markets, which makes it a stable economy with consistent growth due to nationwide demand for its goods. With the area’s unemployment rate hovering around 2.8%, the strong local economy and demand for housing makes this an excellent long-term location for real estate investors.

Tulsa Tulsa boasts the second largest population in Oklahoma and ranks second as the best city to invest in Oklahoma real estate. Average home sale prices reached $223,500 which is an 8% year over year increase. Homes are spending an average of 14 days on the market, with especially hot homes selling for 2% above listing and as quickly as 4 days from the listing date. With some higher education institutions such as University of Tulsa and secondary campuses for the University of Oklahoma that both compete at the NCAA Division I level, the city brings in plenty of permanent residents as well as short term visitors that boosts the local real estate markets.

Norman The unsung hero of Oklahoma real estate, Norman has become an investor’s dream. Average home sale prices reached $253,000 which is a nearly 18% increase year over year and represents a five-year-high for the city. Homes are spending an average of only 9 days on market, while especially hot homes are selling as quickly as 4 days from the initial listing date. As the home of the University of Oklahoma, the city brings in consistent residents and visitors every year which benefits its short term and long term rental markets. With a local economy that’s seeing consistent growth year over year and an unemployment rate hovering around 3%, this city is a great spot for real estate investors to grow their portfolios.

Recently Funded Fix & Flip Projects

Financing Your Oklahoma Fix And Flips

Asset Based Lending focuses on fast closings and flexible underwriting, allowing us to close our rehab loans in 10 days or less on average and work with investors of all experience levels. We provide 12-month interest-only bridge loans that let Oklahoma fix and flip investors acquire the property and begin renovation with reliable financing from start to finish. ABL offers funding that covers up to 85% of purchase price and 100% of the rehab costs, along with the industry’s only true zero-point program. Whether you’re working on your first fix and flip or a seasoned professional, ABL is ready to finance your flip. Click to learn more about our Oklahoma fix and flip loans.

Why Missouri Investors Choose Fix And Flips

Fix and flips are the bread and butter of real estate investing, offering quick projects with healthy profit margins that caters to investors of all experience levels. Oklahoma fix and flips are currently on the rise, with approximately 7% of home sales being attributed to flips. Oklahoma fix and flip investments are seeing an average gross profit of $60,000 as of Q1 2022, making the state one of the more profitable states for rehab investments in the country. With fast moving home sales and rising profits, investors need to partner with a lender that can move as quickly as they can. ABL fix and flip loans close in 10 days on average so our borrowers never miss an opportunity, and with flexible loan terms we’re able to help new investors as well as seasoned professionals. Whether you need to close fast, are seeking flexible loan terms, or another lender simply dropped the ball, ABL is here to help.

Using Hard Money Loans For Fix And Flips

There’s no shortage of ways for investors to finance their acquisition and rehab projects, however not all financing is created equal. For example, there’s no bank or traditional financial institution that is going to close as quickly as a fix and flip investor needs. Plus, banks don’t like to finance full get renovations or any type of home rehab that has a higher level of risk. There’s also private money lenders that offer loans for fix and flips and can close deals quickly, but there’s a lack of security and reliability that comes with it. Hard money loans are the best choice for real estate investors that are looking for fast and reliable funding for their fix and flips. A hard money lender in Oklahoma combines the best of both worlds, utilizing the speed and flexibility of a private money lender with the security and guarantee of a financial institution. The quick closing timeline and high leverage options benefit fix and flip investors far more than other lending options. If you’re a real estate investor looking to finance your Oklahoma fix and flips, then contact us today.

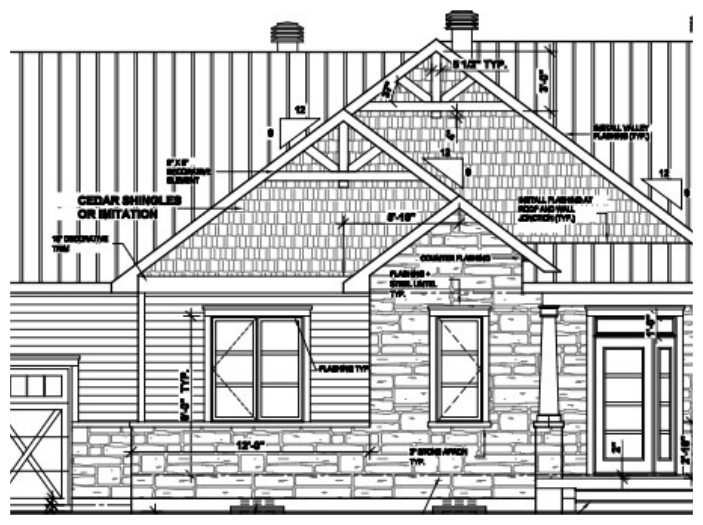

Recently Funded New Construction Projects

Loans For Oklahoma New Construction

Asset Based Lending provides the most trusted new construction loans for real estate investors, offering hard money construction loans ranging from $100K to $3.5M for residential and mixed-use properties throughout Oklahoma. ABL offers these hard money loans for new construction to experienced investors including active builders, developers, or investors that are partnering with trusted general contractors. These new construction loans are tailored to match your specific investment project, ensuring you receive the best terms for your exit strategy with options such as maximum leverage, lower interest rates, zero points, or something else. We utilize a fully in-house professional draw team that manages your draw turnaround so your project never experiences a financial delay. Check out over 500 five-star reviews that our borrowers have given us, and contact us today to be approved for your Oklahoma new construction loan.

Oklahoma New Construction Investment Info

Oklahoma new construction has seen a dramatic increase over the last few years, as the metro areas continue to grow and housing demand outgrows supply. The state experienced its fastest population growth rate in over a decade in 2021, growing at three times the rate of the average state. This has put a strain on current housing supply, but is a green flag for experienced builders and contractors that can fill the inventory gap with single family and multifamily projects. Metro areas like Oklahoma City and Tulsa, along with more suburban markets like Norman and Edmond, have a need for new construction housing. With only two months supply of inventory in the state, the demand for housing is raising prices substantially and benefiting real estate investors that understand the local markets. If you’re ready to use Oklahoma construction loans to scale your real estate business, then contact us today.

Choosing Asset Based Lending For New Construction Loans

When you’re ready to apply for a new construction loan, it means you’re ready to partner with a reliable lender that’s going to take care of your loan from start to finish. Asset Based Lending is here to help, offering fast and flexible financing that’s designed to help builders & developers scale their real estate business effectively. Our professional draw management team reimburses your construction costs without any delays, keeping your project running smoothly until the final sale date. ABL loves to partner with experienced investors on residential and mixed-use construction projects. Whether you’re looking to build a single-family home or develop a multifamily condo, we’re ready to discuss your project and fund your next success. If you’re a builder or developer looking to expand their business, then contact us today to be approved for the best OK new construction loans on the market.

Loans for Oklahoma Rental Property

Asset Based Lending helps real estate investors buy and hold Oklahoma rental property with our streamlined rental loans. ABL term rental loans are designed for investors that want to secure properties between 1-8 units or refinance an entire rental portfolio. We offer competitive terms with rates starting as low as 6.875% with leverage up to 80% LTV. We provide flexible rental loan options to our borrowers including 30-year amortization, ARM, and interest-only options. This program offers a variety of rental loan options with single rental loans up to $3M and rental portfolio loans up to $3M. These loans for rental property are available to investors of all experience levels, assessing each deal based on the income-producing viability of the property. We also offer the ability to use our bridge program to complete property rehab or finance ground up construction before refinancing into a long-term rental loan, making us a one-stop shop for Oklahoma real estate investors. Click to learn more about our rental loan programs.

Oklahoma Rental Markets

Oklahoma is a growing state when it comes to rental property, with its major cities become more popular long-term and short-term destinations. As the biggest city for rentals in the state, Oklahoma City has seen a 12% year over year increase in the average apartment rents. While only 41% of the population rents versus owns, the city’s average vacancy rate hovers around 7% which means finding a tenant shouldn’t be a problem for the right property. Other popular areas like Tulsa have a rental population of 48%, making it easy to fill any rental vacancies you may have and benefiting from the nearly 14% increase in rental prices. Tulsa especially has a steady stream of visitors throughout the year thanks to the University of Oklahoma This consistent flow of tourism and short-term visitors are boosting the short term rental market in the area, making Airbnb and Vrbo properties a viable investment strategy. Whether you’re looking to buy and hold property for traditional long-term rentals or are interested in growing a small portfolio of short term rental properties, Asset Based Lending can help finance your success. If you’re ready to start or grow your real estate rental portfolio using our Oklahoma rental loans, then contact us today.

Why Choose ABL?

We are Local Private Hard Money Lenders

- We understand your local real estate conditions

- We use local appraisers, title agents and closing attorneys

We are a Direct Lender

- We use our in-house money to fund your loans

- We directly control our approvals and closings

We are Reliable and We Close Fast

- Preliminary approval in 24 hours

- Close in 7-10 days

We Manage the Draw Process Efficiently & Quickly

- We help create and approve your draw schedule

- We use local inspectors to assess your progress

- We quickly release your funds when an inspection is approved

Asset Based Lending, LLC was founded in 2010 and is a leading local source of hard money in the residential real estate market. We have consistently received praise from our borrowers who emphasize our quick, hassle-free closings, favorable terms, and creative financing solutions.

Fill out our Pre-Qualification form to start the process.