Fast and Flexible Hard Money Lenders in Delaware

Join thousands of real estate investors across the country that trust ABL to be their lending partner.

One-stop-shop for real estate investor loans

Flips, builds, & rentals

100% construction/rehab financing

Close in 2 weeks or less

Single family, multifamily, mixed-use

Home of the Zero-Point Loan

Light documentation, no tax returns/income verification

Direct balance-sheet lender

Finance Your Delaware Investment

"*" indicates required fields

The Best Delaware Hard Money Lender

Financing your property investment shouldn’t be challenging – that’s why Asset Based Lending delivers fast and simple hard money loans. As the premier hard money lenders in Delaware, we supply real estate investors with loans for fix and flips, new construction, cash out refinances, and loans for rental properties. ABL operated with a fully in-house team for our bridge and term programs, while collaborating with the top local appraisers, attorneys, and title agents in Delaware. ABL has assisted countless investors in expanding their business across the country. Here’s what you can anticipate when you collaborate with ABL’s private lenders in Delaware.

- Quick closings – as fast as 2 days with the appropriate paperwork

- Flexible underwriting – loan programs designed for investors, by investors

- Transparent communication – no hidden fees or surprise costs

- Full service – a one stop shop for all your lending needs

Prequalify Today

Prequalify for your loan today or call us at (201) 942-9090. We approve loans as fast as 24 hours. Our Delaware hard money loans can fund the following projects:

Michael Chadwick joined Asset Based Lending as a Vice President and Area Manager in December 2020, bringing with him over 20 years of real estate and financial services experience in the New England area. Prior to ABL, Michael was responsible for developing and directing the day to day operations for a private lender in the north east where he led the origination and underwriting of over $150 million in loans across 5 states. In addition to Michael’s hard money lending and commercial finance background, Michael has hands on experience as a real estate investor having led a private investment firm through the acquisition and renovation of approximately 150 homes throughout New England. Michael is an expert in managing hard money loans for real estate, with experience in assets ranging from single-family fix and flips to 7-figure multi-family new construction projects and everything in between. His skillset spans many aspects of real estate lending including underwriting, property valuation and analysis, and even construction draw management. His dedication and personal touch have cultivated strong business relationships with his borrowers throughout the years, meshing perfectly with ABL’s lending culture.

Grow Your Real Estate Portfolio. Use Delaware Hard Money Loans Today.

Why Do Delaware Investors Choose ABL? The ABL Difference.

AVG HOME SALE PRICE

AVG DAYS ON MARKET

HOME OWNERSHIP RATE

AVG FIX & FLIP PROFIT

AVERAGE RENT

UNEMPLOYMENT RATE

Local Information for Delaware Real Estate Investors

In the current Delaware housing market, buyers seem to have gained more leverage. This shift can be attributed to a significant slowdown in the market compared to the highs experienced post-pandemic. Consequently, home prices in Delaware are anticipated to decline by around 20% while mortgage rates have seen a substantial surge, increasing by 33.13% from 5.10% in May 2022 to 6.79% in May 2023, nearly doubling. There’s been a steady transformation occurring in the Delaware real estate market. Compared to April 2022, the median sale price in April 2023 saw a slight decrease of 0.14%, while there was a substantial 29.7% drop in the number of properties sold. However, as mortgage rates continue to decline on a weekly basis, currently standing at 6.79%, new buyers are continuing to venture into the market. The real estate market in Delaware is experiencing a gradual return of sellers, as evidenced by an 83.3% increase in listings in April 2023, up from 421 listings in December 2022. Consequently, properties are taking longer to sell, with homes in Delaware remaining on the market for an average of 17 days, a noticeable increase from the 7-day average of the previous year.

Recommended Cities for Delaware Real Estate Investing

Asset Based Lending are experts in local Delaware real estate markets, reviewing trends and shifts to better inform our borrowers while providing the best possible loan terms for each project. Compiling data from Redfin, public town records, and local news sources, we believe some of the best Delaware neighborhoods for real estate investors are:

Newark

Located in New Castle County, the small city of Newark is home to a variety of creeks, trails, and gardens, making Newark housing market a competitive area for suburb seeking home hunters. The average day on market is 5 as of May 2023 and each home receives an average of 8 offers. Newark Delaware home priced were down 1.5% compared to May 2022, selling for a median of $375,000. There were 20 homes sold in May 2023, down from 25 the previous year. According to Redfin, most homes in Newark get multiple offers with waved contingencies. The average homes sell for about 2% above list price and are pending after around 5 days as of May 2023. From March 2023 to May 2023, 80% of Newark homebuyers looked to stay within the Newark metropolitan area, while 20% searched to move out of Newark. New York homebuyers searched to move to Newark, DE more than any other metropolitan.

Rehoboth Beach

This beachy Delaware summer town makes the property market in Rehoboth Beach moderately competitive. The average homes sell for about 4% lower than their list price however, hot homes can sell in as little as 15 days on the market at list price. On average, properties in Rehoboth Beach receive three bids and typically sell in approximately 46 days. As of May 2023, the median sale value for a Rehoboth Beach home reached $855,000, a rise of 10.7% from the previous year. The median price per square foot in Rehoboth Beach stands at $375 as of June 2023, marking a 15.3% decrease from the prior year. In March 2023-May 2023 Washington State homebuyers searched to move in Rehoboth Beach more than any other metropolitan area followed by Philadelphia and New York. Rehoboth City is home to less than 1,500 permanent residents. A considerable number of individuals with a Rehoboth address reside beyond the city limits. However, during the summer season, the city’s population dramatically increases, exceeding 25,000 people. These types of stats point towards rental property being a good investment, especially short-term rentals like Airbnb and Vrbo, taking advantage of the constant tourism that visits Rehoboth Beach in short bursts.

Wilmington

The property market in Wilmington is highly competitive, with homes typically receiving around five offers and selling in about 14 days. In May 2023, the median sale price for a home in Wilmington was $280,000, reflecting a 7.2% increase compared to May 2022. The price per square foot has also seen a rise, standing at $173, marking an 11.2% increase from last year. However, home sales have decreased, with 157 properties sold in May 2023 compared to 211 the year before. It’s common for many homes to receive multiple bids, some even with waived contingencies. Homes in Wilmington, DE generally sell for the list price and are pending in about 14 days. Properties that are in high demand may sell for about 4% above the listed price and become pending in roughly 4 days. Between March and May 2023, one-fifth of Wilmington homebuyers considered relocating from the city, while 80% intended to stay within the metropolitan area. An interesting split exists among households in Wilmington, DE where 56% or 17,675 are renter-occupied as of June 2023, while the remaining 44% or 13,717 are owner-occupied. Asset Based Lending caters to builders and developers interested in using new construction loans to take advantage of the Wilmington market’s competitive demand for homes.

Recently Funded Fix & Flip Projects

Financing your Delaware Fix and Flips

Asset Based Lending specializes in providing fast financing solutions, particularly for investors involved in fix and flip projects. Our approach to flexible underwriting allows us to work with several different types of rehab projects. On average, we’re capable of closing our rehab loans within 10 days or less, ensuring you don’t miss out on potential opportunities. These 12-month, interest-only bridge loans allow Delaware investors to purchase and initiate renovations with the most competitive rates available in the market, including the only true zero-point program in the industry. ABL provides funding that covers up to 85% of the purchase price and fully supports the rehab costs. Whether you’re getting started on your first fix and flip or are an experienced professional, ABL is prepared to finance your project. Click to find out more about our fix and flip loans in Delaware.

Why Delaware Investors Choose Fix and Flips

Fix and flips are one of the most consistent and reliable forms of real estate investing, offering profits that allow investors the ability to funnel that capital into their next projects. In 2022, Delaware generated the largest returns on investment (ROI) from fix and flips, providing a 96.1% return on average. According to ATTOM Data Solutions, despite selling in a down market, Delaware fix and flip investments saw an average 26.9% ROI as of May 2023. Flippers grossed $193,245 per property in 2022, making Delaware fix and flips the largest return on investment in 2022. More than one-third of real estate investors use outside financing for their projects, so rehabilitation construction is that much easier for the borrower. Our fix and flip loans focus on closing in 10 days on average, so our borrowers never miss an opportunity due to financial delays. Whether you need to close fast, are seeking flexible loan terms, or another lender simply dropped the ball, ABL is here to help.

Using Hard Money Loans for Fix and Flips

Securing financing for a fix and flip investment demands a lender who can finalize deals quickly and offer an array of loan alternatives. This is the reason why a significant number of real estate investors favor hard money loans for their fix and flip ventures. Such loans can be closed in under two weeks and have flexible terms. Asset Based Lending has been known to finalize loans in as little as two business days when all necessary paperwork is in order. These expedited loans afford fix and flip investors the chance to capture deals that might otherwise be lost with other financing choices. Apart from current bank statements and a credit assessment, hard money lenders typically overlook the need for documents like tax records or proof of income. Investors who have tried to borrow from traditional banks or other financial institutions are all too familiar with the resistance. These projects are naturally high risk, and banks often shy away from them. If they do decide to lend, the process is typically slow and comes with numerous loan conditions, such as prepayment penalties or extensive documentation requirements, that can be detrimental to the deal from the investor’s perspective. When it comes to fast and effective lending for fix and flips in Delaware, hard money loans are the top choice for borrowers, and no one does it better than ABL.

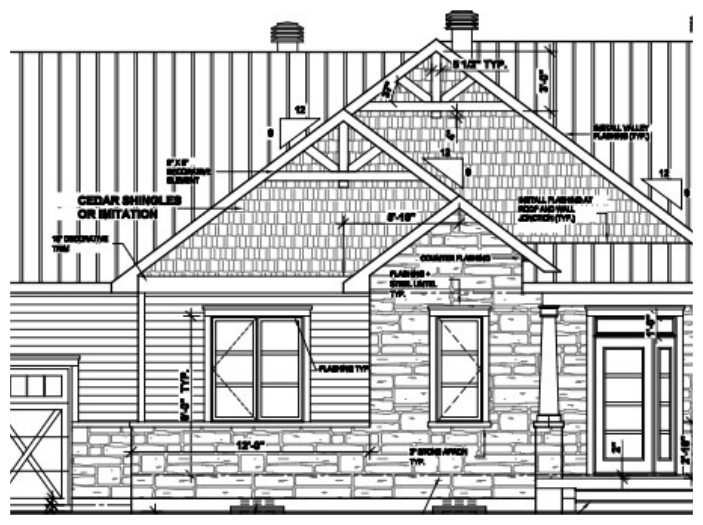

Recently Funded New Construction Projects

Loans for Delaware New Construction

ABL provides hard money loans for new construction to real estate investors that are seeking competitive interest rates, fast draw turnarounds, and flexible underwriting. These 12-month new construction bridge loans are available to seasoned investors, builders, and developers who can borrow up to 70% of the land value and 100% of the construction costs. ABL tailors our ground up construction loans to match each individual project, ensuring the borrower receives the best loan terms for their business strategy. We assess the investor’s experience level and the viability of the project to determine whether the deal is profitable for all parties. Whether you’re looking to finance the ground up construction of single family or multifamily projects, ABL is ready to discuss your upcoming deals. Click to learn more about our new construction loans.

Delaware New Construction Investment Info

Delaware favors building a home rather than buying one, where home hunters could save around $96,000 if they build a home as of March 2023. However, the supply of newly constructed homes in Delaware is limited. If there is no way for homebuyers to acquire land or get regulatory approval, then new construction in Delaware will continue to decrease. As of April 2023, there is a 2.6 months’ supply available, but home prices in Delaware are predicted to remain stable throughout 2023. Also, because of the strong demand for homes across various Delaware demographics, new buyers are entering the market. As a result, inventory is limited with fewer foreclosures.

Choosing ABL for New Construction Loans

With the surging popularity of real estate investing and the continuous growth of new construction, an increasing number of investors are seeking extra capital and discovering that it is not as straightforward as it initially seems. An initial choice for many investors is to approach banks; however, banks are highly risk-averse and often shy away from granting loans for new construction due to their excessively restrictive criteria or flat-out loan denials. While some investors seek out bank financing or private money loans, they realize the slow nature and strict guidelines of bank loans or lack of reliability from a private money lender ends up costing them deals or causing more issues instead of making things easy. Private hard money lenders in Delaware are common and popular, as the hard money loans they offer are perfect for new construction projects. A hard money loan offers the best of both worlds by combining the stability and dependability of a traditional bank loan with the swiftness and adaptability of a private money loan. This financing solution ensures that borrowers can have complete confidence in the guaranteed and timely delivery of their funds. Whether you aspire to construct a few homes annually or are prepared to expand into multifamily development, reach out to us today to discuss your upcoming projects.

DSCR Loans for Delaware Rental Property

Asset Based Lending offers simple and reliable Delaware rental loans. These term rental loans are designed for buy and hold investors that want to secure properties between 1-8 units or refinance an entire rental portfolio. We offer competitive terms with rates starting as low as 5% with leverage up to 80% LTV. Our goal is to provide the most flexible rental loan options to our borrowers including 30-year amortization, ARM, and interest-only options. ABL offers a variety of rental loan options with single rental loans up to $3M and rental portfolio loans up to $3M. These loans for rental property are available to investors of all experience levels, assessing each deal based on the income-producing viability of the property. We also offer the ability to use our bridge program to complete property rehab or finance ground up construction before refinancing into a long-term rental loan, making us a one-stop shop for Delaware real estate investors. Click to learn more about our rental loan programs.

Delaware Rental Markets

With the population increase of almost 29,000 between 2022-2023, home prices are up 1.3% year over year as of May 2023 compared to the previous year, selling for a median price of $327,300. The number of homes sold however is down 25% this year compared to 2022 at 695 since May 2023. That is 28.3% fewer sold homes for 2023, which is an all time low for Delaware. Short-term vacation rental properties in cities like Rehoboth Beach are good indicators of profitability in a market that should constantly be in high demand. Median monthly rent in Rehoboth Beah was $1,231 for a weekend as of June 2023. Single family homes in Rehoboth Beach sold for an average of $915,000 in June 2023 and spent 114 days on the market. The inventory of 51 experienced a 2% relisting where the average price per square foot was $354. If you’re ready to start or grow your real estate rental portfolio using our Delaware rental loans, then contact us today.

Hard Money Bridge Loans for Stabilized Property

As fluctuations are observed in real estate markets, it’s important for borrowers to adapt their exit strategies accordingly. This is why Asset Based Lending is now offering bridge loans for stabilized properties, presenting borrowers the flexibility to recalibrate their investment and wait until the market conditions align with their intended exit. These bridge loans cater to investors who have recently finished a renovation or ground up construction but consider the current market conditions unfavorable for their existing exit strategy, so they decide to hold the property as a rental. If you’re an investor considering a fully equipped rental property that you plan to sell or refinance once the mortgage rates decrease, this may be a suitable solution for you. Regardless of the situation, an interest-only loan without pre-payment penalties is available to bridge the financial gap.

How Do these stabilized Bridge Loans Work?

Our 2-year debt service coverage loans can help bridge your financing for up to 24 months with no prepayment penalty, so you can exit the loan whenever you’re ready. With extensions available for an additional fee, we’ll make sure you’re properly financed from start to finish so that you have time to determine your final exit strategy and capitalize on your investment at the right time. We can provide stabilized financing for properties up to 20 units, using the lesser of either market rent or leased rent to determine the DSCR and deliver you competitive loan terms. While all loans are different and structured to meet the individual investor’s needs, the typical stabilized loan is a 2-year interest-only loan with rates starting at 10.5% and LTV up to 65%-70%. Loan terms are determined based on factors such as borrower experience, FICO score, and DSCR, using the lesser of either market rent or leased rent to determine your DSCR. If you have a deal that requires temporary bridge financing, then contact us today.