Tampa Hard Money Lenders

The Premier Hard Money Lenders In Tampa FL

Asset Based Lending are the premier choice for hard money loans in Tampa and the rest of Florida. We are a private money lender in Tampa that funds real estate investments including fix and flips, new construction, and long-term rental portfolios. With over a decade of proven success and hundreds of verified five-star reviews, ABL offers the fastest and most reliable loans for real estate investments in Hillsborough County and beyond.

We specialize in finalizing deals quickly, approving loans as fast as 24 hours and closing them in 10 days or less. ABL makes loans in Tampa, FL simple with our streamlined process and professional draw management, handling the loan from start to finish and providing initial funding within three days. Our flexible underwriting allows us to tailor loans to match your specific projects, ensuring you receive the best possible loan every time. If you’re ready to be approved for a hard money loan in Tampa, contact our team of hard money lenders today.

Learn more about:

Close In 10 Days Or Less With Tampa’s Best Hard Money Lender

Tampa Fix And Flips Ready To Explode

The massive migration occurring from places like New York and California to Florida has led to a huge demand for real estate along with record-low inventory. This kind of market is perfect for fix and flip investments, offering large ROI for investors that can spot a distressed property that they know they can renovate into a beautiful home. As of January 2021, the average home sale price is $284,900 which is a nearly 12% increase from the previous year. 917 homes sold during the month, which is a 16% increase from the previous year and highlights how hot the market currently is.

The city is clearly a competitive seller’s market, but the higher prices and number of home sales are just part of the picture. Currently, the average number of days homes are spending on the market is 18 days, which is a nearly 53% decrease from the previous year. The incredibly short time on market means fix and flip investors can chain together several profitable deals in the city throughout the course of a year. For any real estate investor looking for Tampa fix and flip loans, contact our hard money lenders today.

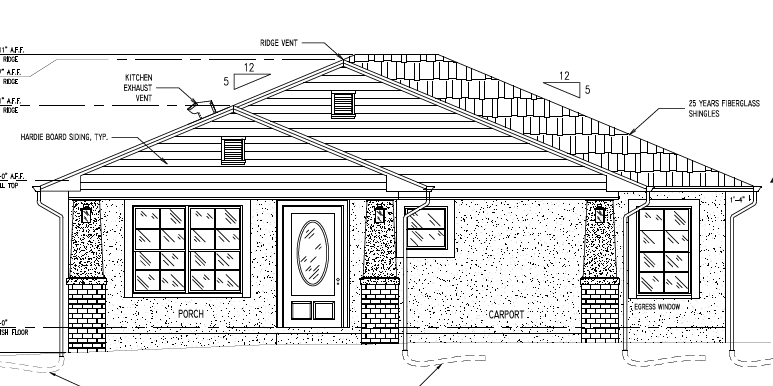

New Construction Needed in Tampa

The mix of increased demand and record-low inventory has created a major need for new construction in the city and the rest of Florida. In many cases, homes are selling based solely off the plans rather than after construction is completed! As of January 2021, homes are selling for $177 per square foot, marking an 11% increase from the previous year. If an experienced contractor or builder can secure their materials at a reduced cost, then they could see a high ROI with Tampa new construction.

When entering a new real estate market, its important to note the ongoing trends to determine the needs of the home buyers. Currently, the online home listings seeing the most attention are properties that feature guest bedrooms, large living rooms, and fenced back yards. The homes with these are getting more views, more bids, and selling for slightly above the initial asking price. Including these into your construction plans can help you build towards the market’s desires and ensure you sell the house quickly and at the highest possible price. Our team can help experienced contractors and builders with Tampa new construction loans, so contact us today.

Investing In Tampa Rental Property

Due to a large influx of new residents into Tampa and the rest of Florida but a shortage of housing inventory, many people are looking to rent until permanent residences become available. Real estate investors can take advantage of this by purchasing a rental property and filling it with a tenant to generate passive monthly income that they can use to fund future real estate investments.

Experienced real estate investors are currently utilizing the BRRRR strategy, which stands for buy, renovate, rent, refinance, and repeat. The method is simple: investors purchase the rental property and renovate it to increase its market value and allow them to charge a higher monthly rent. Once its occupied and generating monthly revenue, the investor refinances the property and uses their newly acquired capital to fund the purchase of their next rental property, repeating the process all over again. This BRRRR method is great for investors looking for long-term gains and passive monthly income. If you’re looking to begin or expand your rental portfolio with our Tampa rental loans, contact us today.