The BRRRR Strategy for Beginners in Real Estate Investing

Though plenty of “get rich quick” real estate courses and schemes abound these days, few new real estate investment strategies beat the classics – and perhaps none is as classic as the BRRRR Method. The BRRRR Method (short for buy, rehab, rent, refinance, repeat) is a time-tested sequencing strategy to give new and experienced real estate investors a simple template to kickstart an investment, generate income, and eventually realize a return on the original investment.

What is the BRRRR Method for Beginner Real Estate Investors?

The BRRRR Method is popular among real estate investors of all types, but it stands out for beginners on two core fronts:

The BRRRR Method is essentially a “how to” guide or a playbook detailing each step of the investment in sequence so real estate investors can focus on their short-range goals and targets without getting caught up in the weeds.

The BRRRR Method is both manageable and scalable. This means investors can speed up or slow down a specific investment according to their life circumstances or capital requirements. Likewise, you can execute the playbook on multiple properties simultaneously once you have some experience and are comfortable growing.

Before looking at the steps in-depth, the BRRRR Method for beginners can be summed up simply:

- Buy a property that’s undervalued relative to its potential.

- Improve the property, then rent it out.

- Refinance the original loan to generate long-term income or scale your investment cycle to an additional property (or, more likely, do both!).

Unlike fix and flips or new builds, building a rental portfolio with the BRRRR Method isn’t about cashing out quickly or hitting a big payday. Instead, the BRRRR Method aims to create a long-term, reliable source of cash flows while benefiting from general property appreciation as you hold the home while renting.

How Does the BRRRR Method Work?

With the highlights out of the way, how does the BRRRR method work in practice? While your specific goals and circumstances will drive some of the nuances, most BRRRR beginners tend to execute their investment cycle along these lines:

Buy the Property

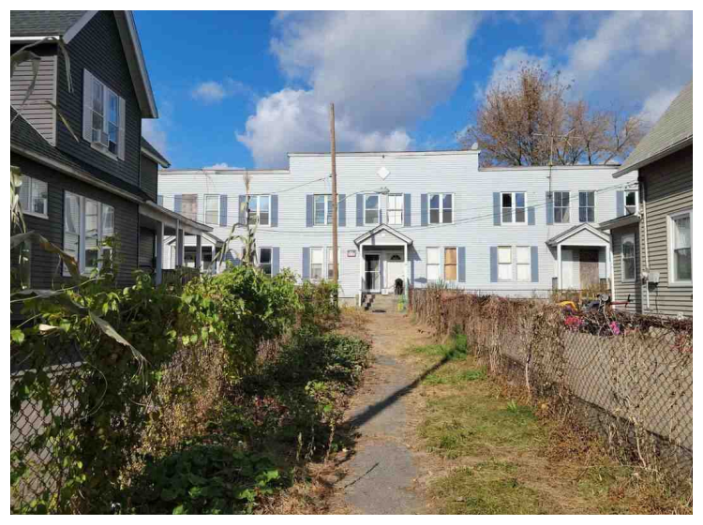

Whether single or multifamily, the reality is that properties generating the greatest long-term return on investment tend to be distressed properties. This can mean they’re in a state of modest disrepair (or worse), the original owner defaulted on their mortgage, a bank owns the property, the property is pending or in foreclosure, or a range of other distressed property types.

Distressed properties, of course, also tend to be the riskiest (especially if they need a lot of TLC). Moreover, traditional lenders (like banks) tend to take a skeptical approach toward lending against a distressed property unless you have an established history of successful BRRR cycles or fix-and-flips. Unless you can buy a property outright, you’ll likely need to explore alternative solutions like short-term loans via hard money lenders.

Be sure to budget for repairs, too! It’s likely best to overestimate your repair and rehab budget, especially if the property is older or in worse shape than comparable properties in the area.

Rehab the Property

Once you either buy the property outright or secure financing and it’s in your hands, you’re ready to rehab it and get it up to snuff. Depending on the property’s current state, this can range from basic aesthetic upgrades and modernization to full-scale gutting to rebuild from the home’s bones.

Remember that, here, the goal is speed alongside quality. Most riskier loans associated with distressed properties tend to have higher rates than traditional mortgages, so the sooner the property is ready to refinance, the more money you’ll save in interest payments.

At the same time, don’t sacrifice quality – remember that someone will be living in the home when you rent it, so don’t go for the lowest-end materials and create an undesirable living space or, worse, a dangerous home for inhabitants. The goal is also to create greater long-term value through property improvement (maximizing after-repair value, or ARV, in other words), so striking the right balance between speed, costliness, and quality is a delicate maneuver that takes some practice to get right.

Some of the most common areas to maximize return on rehab investment include:

- Kitchen renovations

- Replacing or expanding fixtures like overhead lighting

- Painting

- Dividing larger rooms into two bedrooms (if the space allows it) or turning smaller spaces like hall closets into half-baths.

Rent the Property

You’re ready to rent once you complete rehab. This stage is the proving ground for your rehab – is the property attractive and high-quality enough to fill quickly (with reliable tenants)?

Remember that closely managing your tenancy applications and running due diligence on potential renters can make or break your BRRRR method planning. Outsourcing background checks and the like may be a good first move if you’re newer to real estate investing. Likewise, depending on how much time and expertise you have, finding a property manager to take day-to-day dealings off your plate may be advisable.

Remember, though, that rental cash flow considerations often break down into individual dollars, especially when you’re carrying a higher interest rate loan, so be sure to carefully balance monthly rent, expenses like maintenance costs, and how much you’re willing to fork over to third parties to help alleviate time and effort.

Refinance the Loan

Now that you’ve proven the property’s viability with a paying tenant and lease agreement, it’s time to offload the higher-rate bridge loan into one more practical to carry for the long haul. Working with the same lender who extended the original loan can save time as you’re operating within an existing relationship, but it doesn’t hurt to shop around during this phase (as long as you don’t take too long!).

Note that you’ll likely want to cash out a portion of the home’s newfound equity you built through renovation to keep the cycle going. This will help continue the BRRRR Method in our final step:

Repeat

Whether it’s your first or fiftieth, nothing is more satisfying than the final step of the BRRRR Method – repeating what worked (and avoiding what didn’t). You’re on your way to building a well-rounded real estate portfolio. As your strategy scales, you open new opportunities for property sizing, more expansive rehabs, and even outsourcing some of the harder parts so you can focus your attention where it matters most.

Property Considerations for the BRRRR Method

As we said, there’s no “best” property for BRRRR beginners. Still, a few considerations and due diligence upfront can save time and hassle down the road while helping ensure you maximize the method’s benefits:

Look for value-add properties that need some TLC but aren’t total teardowns or disasters. Striking a balance is a delicate maneuver, but for your first project, you may want to err on the side of properties needing basic cosmetic upgrades and updates rather than a full-scale demolition.

At the same time, turn-key properties (those ready to rent) aren’t the best for the BRRRR Method – you’re banking on an immediate ARV increase to pay off the bridge loan and interest while securing enough capital from a cash-out refinance to repeat the process.

A good rule of thumb for how much house you can afford under the BRRRR Method is the 1% rule – monthly rent should be worth at least 1% of the home’s value or purchase price. For example, a $300,000 home should generate at least $3,000 monthly. A good way to ballpark whether this is feasible is to run the numbers on what local rents are first to get a baseline, then start property hunting with that top-line number in mind. You can also use our free BRRR calculator if you’d like to crunch some more numbers.

Hard Money Lending and the BRRRR Method

Banks tend to take a skeptical view of speculative real estate investing, and they’re clamping down more than ever as interest rates force them to trim their book and assume fewer new loans. For this reason, finding a hard money lender to kickstart your BRRRR Method tends to be the fastest and most streamlined way to start building long-term rental cash flows.

But these lenders don’t just offer financing. Since they tend to work in the industry, you’re also building a relationship and tapping into an existing network of BRRRR Method expertise that wants to see you succeed as much as you do.

We’ve funded more than $1.4 billion in deals but, more importantly, we’ve helped thousands of investors like yourself get their start in real estate investing through the BRRRR Method and helped them grow, scaling our services as their needs grow. To see if you’re eligible to work with us click here to pre-qualify today.

0 Comments