Exploring the Contrast: Real Estate Price Growth vs. Rental Prices in the United States

Over the past six years, the U.S. housing market has experienced significant fluctuations due to the uncertainties brought about by the pandemic, rising inflation, and supply constraints. In October 2018, the overnight federal funds rate stood at 2.19%, marking a 10-year high at that time.

However, this rate has surged to 5.33% today. The repercussions of the Federal Reserve’s multiple interest rate hikes are being keenly felt by prospective homebuyers, prompting many to explore the rental market as a practical alternative.

The question arises: is renting more affordable than homeownership? To assess the growth in real estate prices since 2018 in comparison to rental prices, Zoocasa conducted an analysis of median home prices and rental data in 15 cities across the U.S., evaluating the percentage differences.

Rental and home prices have surged nationally and locally in the past five years, except for San Francisco and Baltimore. Across all analyzed markets, the growth in median home prices has outpaced that of median 1-bedroom rents. Every market saw a median home price growth of over 30%, whereas rent growth showed more diverse patterns.

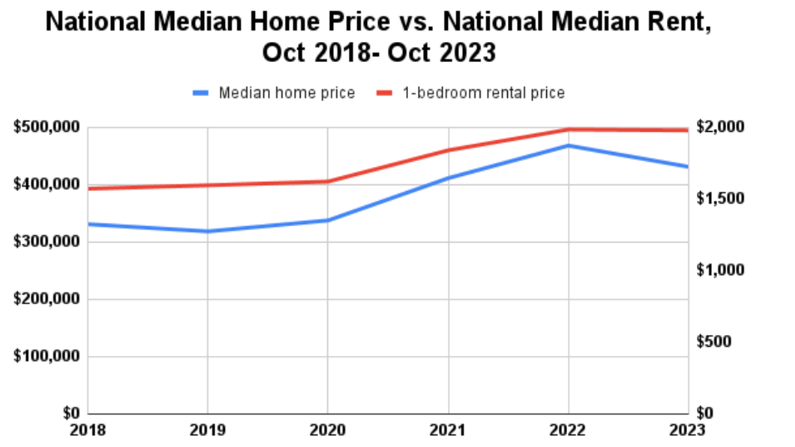

In certain markets the difference is less noticeable, as rent growth aligns more closely with the pace of home prices. The national median home price was $330,900 in Q3 2018, experiencing a 30.3% increase to $431,000 in Q3 2023. National rent is not far behind, increasing by 25.9% from 2018 to a median price of $1,978 in 2023.

Columbus, OH showed the smallest difference in price growth between the rental and resale markets, with rents increasing by 54.6%, the highest among all analyzed rental markets, and home prices rising by 57.3%.

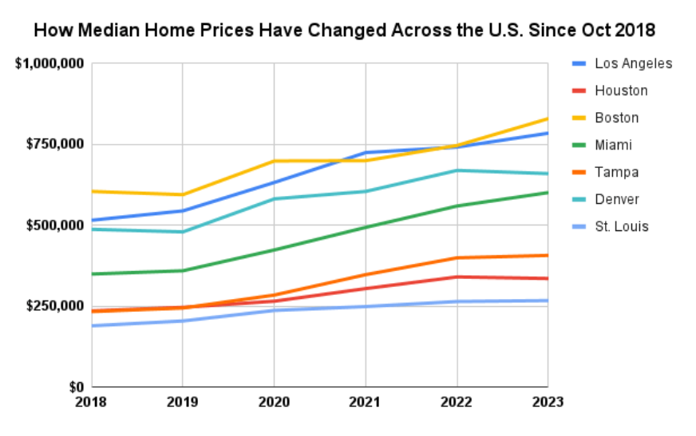

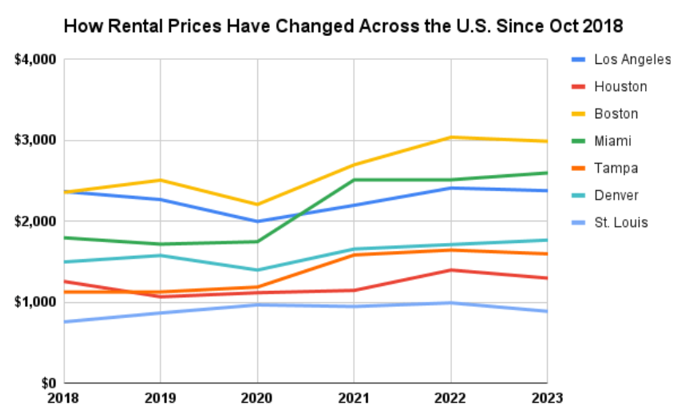

Following closely, Boston, MA saw the median home price climb from $605,000 in 2018 to $829,950 in 2023, marking a 37.2% increase. Concurrently, median 1-bedroom rent in the city rose from $2,359 in 2018 to $2,990 in 2023, reflecting a 26.7% increase.

Among the cities analyzed, Boston boasted the highest rental prices and the second-highest home prices, trailing just behind San Francisco, CA, with a median home price of $1,268,940 in 2023.

San Francisco, despite having the second-highest rental costs, is noteworthy as it is one of the few cities, along with Baltimore, where rent exhibited a slowing down, decreasing from $3,649 in 2018 to $2,970 in 2023.

Two additional cities, aside from Columbus, OH, witnessed growth exceeding 40% in both rent and home prices: Miami, FL, and Tampa, FL. Miami saw the most substantial surge in home prices, skyrocketing by 71.9% over the past 5 years, accompanied by the second-highest increase in rent at 44.5%.

Recognized as one of the most dynamic markets in the U.S., those considering Florida for residence might find Tampa more budget-friendly, as its median home price is merely a third of that in Miami.

Market Adjustments in Progress

In both the rental and resale sectors, prices are gradually moderating from their pandemic-induced peaks, creating a window of opportunity for potential buyers to enter markets that were once beyond their reach.

Between 2022 and 2023, Houston, TX, Denver, CO, and Nashville, TN observed a decline in median home prices, with Denver witnessing the most significant year-over-year decrease, amounting to $10,000. Furthermore, Denver had the second-smallest price increase from 2018 to 2023, registering at 35.2%.

A decline in the median rent price occurred in eight markets from 2022 to 2023, including cities such as Los Angeles, CA, Dallas, TX, Boston, and Tampa. In locations like Los Angeles, Buffalo, NY, and Houston, the rental landscape has seen minimal shifts over the past five years, with increases of merely 0.4%, 2.9%, and 3.2%, respectively.

Buffalo stands out as a more cost-effective market for home prices compared to others, with prices nearly half of the national median. Consequently, there is less demand for rental properties in Buffalo, particularly in contrast to markets where prospective homebuyers are priced out.

In review,

In the analysis of the dynamic relationship between real estate price growth and rental prices in the United States, it becomes evident that markets vary significantly in their trends and trajectories.

The upward trajectory of median home prices across different cities surpassing the growth in rental prices paints a nuanced picture, revealing intriguing trends like the slowdown in specific rental markets and the sway of affordability influencing demand.

Real estate investors need to analyze their local markets to determine what the best course of action is for their business strategy. Some markets will favor the BRRRR investment model, while others will benefit more from traditional fix-and-flip projects.

0 Comments