What does Baltimore have to offer?

A half hour from DC by train, Baltimore is a popular location for commuting professionals looking to save on living costs: Baltimore rent is 43% lower than rent in the Capitol City. Baltimore is also full of historical buildings and sites; Francis Scott Key even wrote the Star-Spangled Banner here.

Baltimore’s population is around 620,000, and the city provides plenty of cultural entertainment and events to satisfy its residents – the local Orioles fan base makes Baltimore one of the biggest baseball cities in the US.

With more than 225 neighborhoods in the city, Baltimore is full of promising investment opportunities for investors willing to put in the work to find them.

[su_note note_color=”#ffffff” text_color=”#282828″ radius=”0″]

Baltimore Demographics

[su_row][su_column size=”1/5″][su_icon_panel icon=”icon: user” icon_color=”#095566″ icon_size=”50″]611,648 Population[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: suitcase” icon_color=”#095566″ icon_size=”50″]0.2% 1-Year Employment Growth[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: money” icon_color=”#095566″ icon_size=”50″]$47,131 Median Household Income[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: birthday-cake” icon_color=”#095566″ icon_size=”50″]Median Age: 35[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: car” icon_color=”#095566″ icon_size=”50″]67% Commute By Car[/su_icon_panel][/su_column][/su_row][/su_note]

Baltimore Real Estate Trends

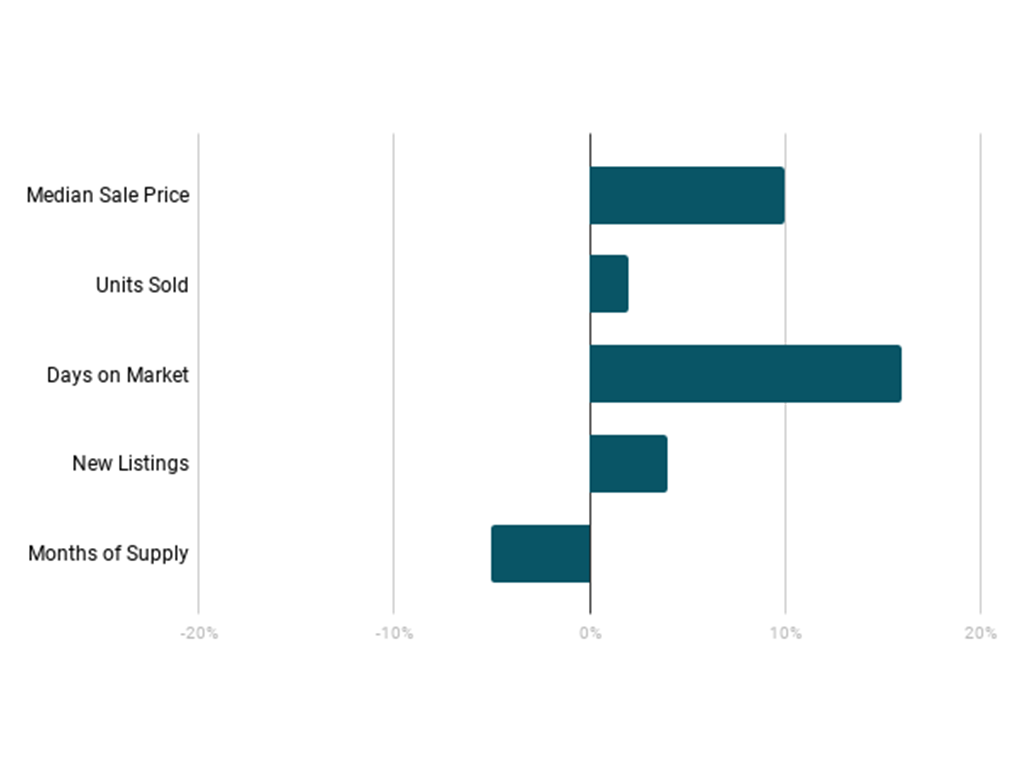

[su_row][su_column]Although the 16% increase in days on market may cause concern, the number of months supply decreased over the last year, suggesting that demand in the Baltimore housing market outweighs supply. Even though properties are spending longer on the market than they were at the same time last year, Baltimore homes are still moving relatively quickly with an average of 65 days on market. Additionally, the number of units sold and median sales price each increased – two promising signs for investors.

With property prices around half of the rest of Maryland’s, Baltimore’s real estate is highly discounted despite its proximity to Washington DC. The discount likely comes from Baltimore’s reputation for crime. Although Baltimore is one of the 100 most dangerous cities in America, it’s also home to high numbers of working professionals and students – top universities like Johns Hopkins, UMD, and Loyola have massive campuses across the city, providing a continuous pool of renters as new students and faculty look for off-campus housing.[/su_column][su_column]

City vs. State: Market Values

| Baltimore | Maryland | |

| Median List Price | $169,900 | $325,000 |

| Median Sale Price | $134,200 | $290,000 |

| Medial List Price per Sq. Ft. | $144 | $189 |

| Rent Index | $1,289 | $1,804 |

| Rent List Price per Sq. Ft. | $1.24 | $1.33 |

[/su_column][/su_row]

- Baltimore Real Estate Trends

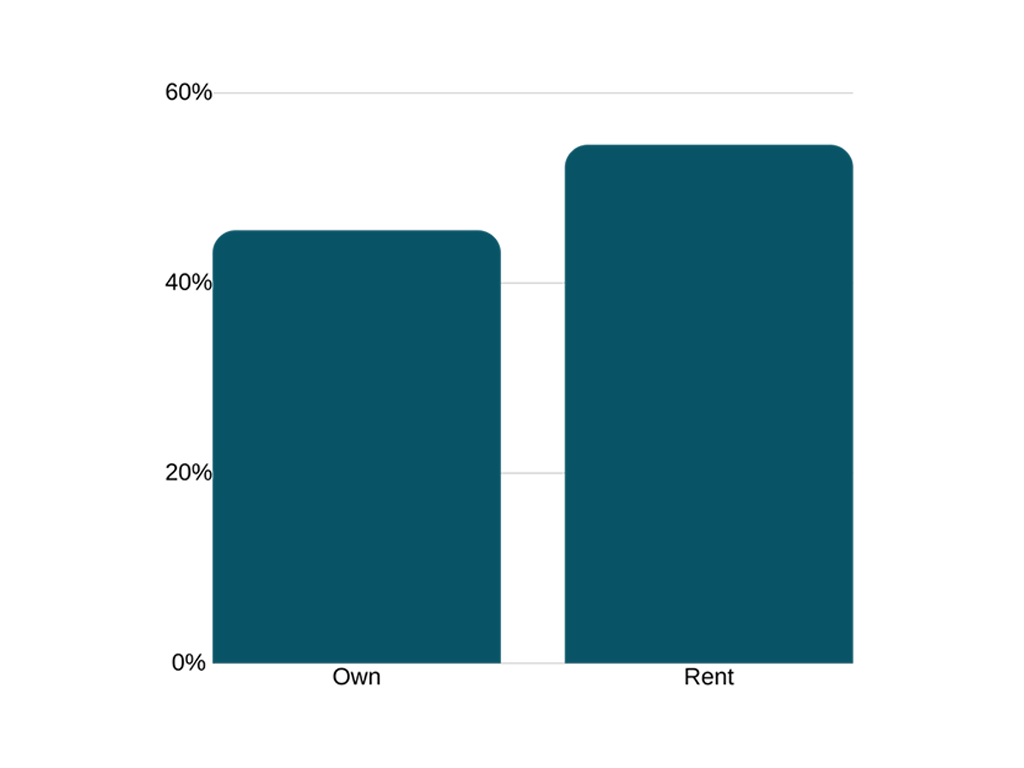

- Baltimore Homeownership Data

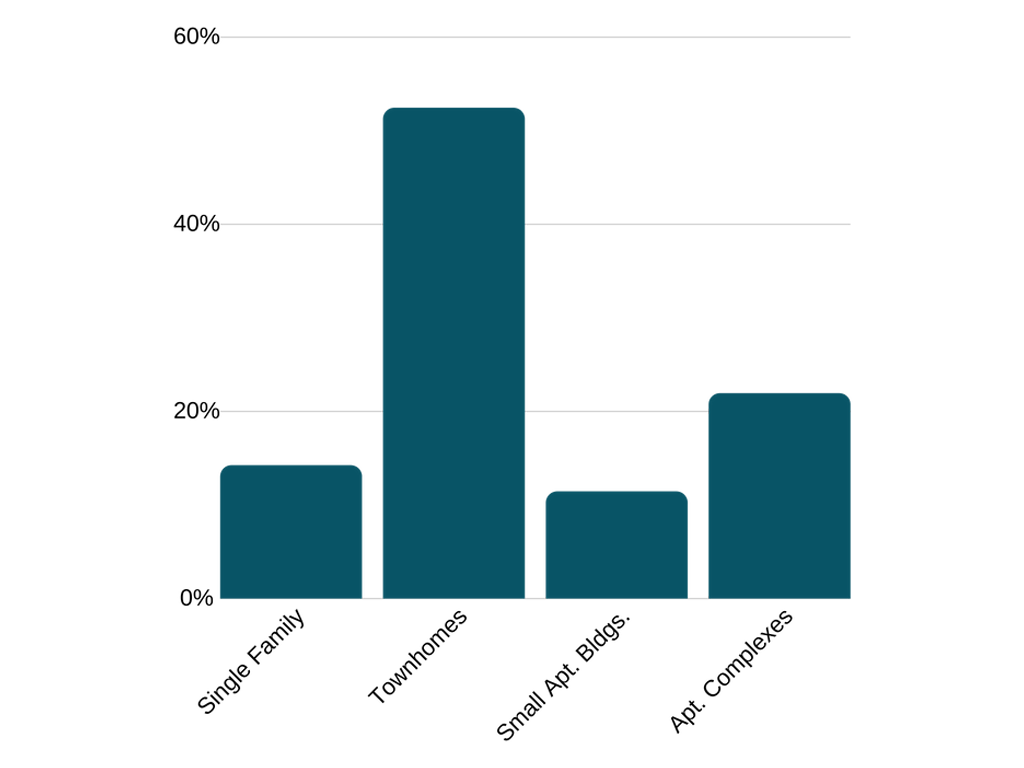

- Baltimore Home Type Data

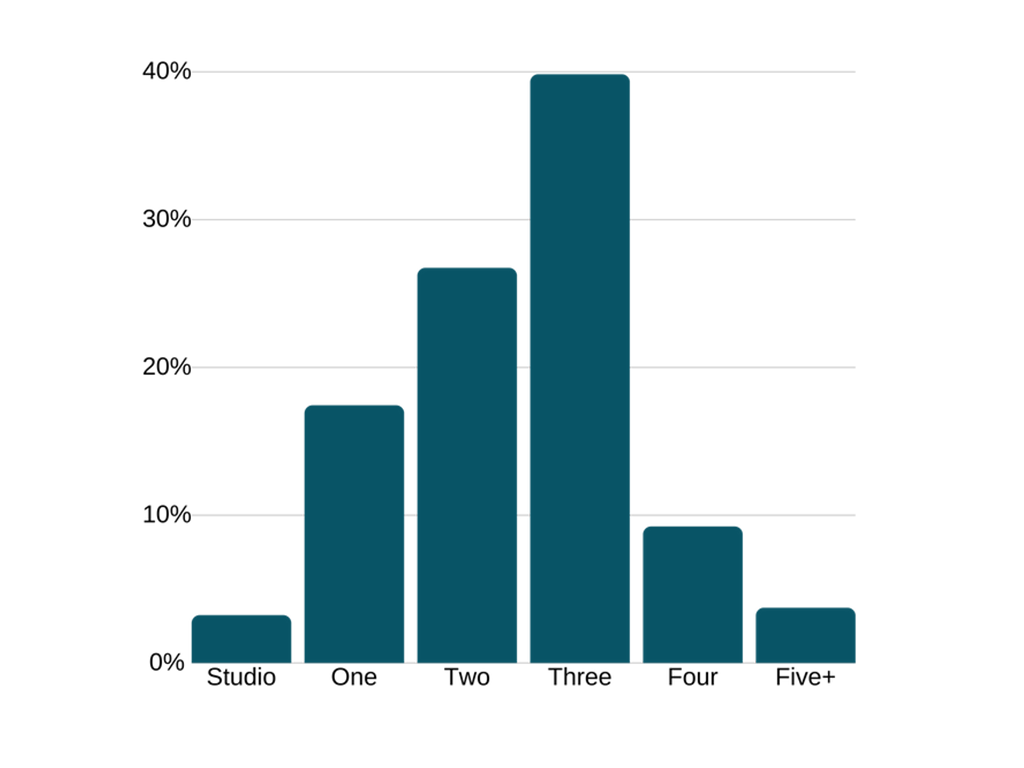

- Baltimore Home Size Data

Investing in Baltimore Real Estate

Baltimore is one of twenty-two major US cities where more people rent their residences than own them, making it an ideal location for investors interested in building a rental portfolio. Most of our ABL investors are buying single-family properties for $30,000 to $75,000, putting in around $40,000 of rehab to make the properties livable, and seeing the value jump to anywhere from $130,000 to $150,000.

Hold to Rent

The preferred strategy in the current real estate market for Baltimore investors has shifted towards a buy, rehab, and rent approach. For ABL borrowers, this means leveraging our Rehab to Rent loan program to transition from the short term hard money loan to the longer term, lower interest rate investor refinance. For one to two bed apartments, investors can expect rents of around $1,000/month.

Since most renters here are looking to save money by living outside of DC, you’ll have more interested tenants if you keep updates minimal and rent low. To keep rehab costs down and avoid expensive improvements that Baltimore renters aren’t asking for, design a scope of work that will ensure that the apartments are low maintenance, livable, clean, and fully functioning.

Fix & Flip

Although rental strategies are the most common, there are still great opportunities for fix and flips in Baltimore. Be cautious where you choose to invest to flip, because there are many areas in the city where properties simply aren’t selling. Check Redfin or Home Snap to see where listed houses are selling before starting your property search, or consult a realtor with local knowledge to target ideal fix and flip neighborhoods.

Investors can increase their gross return by investing in row homes in areas with a higher price point, then updating key spaces like the kitchen and bath for a final sale price of $200,000 to $250,000.

Where to Take Caution

If you are renovating a Baltimore property, choose your neighborhood carefully and protect your property during construction. There’s no need to limit yourself to white picket-fence neighborhoods, though; a lot of money can be made in regions with a rougher side. Just be aware of the risks and take on projects that match your experience level.

Additionally, you should only work with contractors you know and have worked with before (or come highly recommended!). Locals can have valuable insight, but vet everyone you hire carefully and only work with people you know you can trust.

Best Baltimore Neighborhoods for Real Estate Investors

Union Square

Median Home Price: $187,500

This historic neighborhood is named for the park at its center. There are several art galleries and studios in the area, as well as Civil War period architecture and streets. Most of the properties are row homes and rentals.

[su_row][su_column]

Walkability & Transit Scores

[su_progress_bar percent=”89″ text=”Walkability Score – 89%” fill_color=”#67cb36″]

[su_progress_bar percent=”65″ text=”Transit Score – 65%” fill_color=”#f0ca1c”]

[/su_column][su_column]

Union Square Ratings:

| Housing | C- |

| Public Schools | C- |

| Crime & Safety | C- |

| Cost of Living | B |

[/su_column][/su_row]

Patterson Park

Median Home Price: $230,000

Near Johns Hopkins, Patterson Park is surrounded by collegiate attractions like restaurants, bars, free concerts, and cultural events. The available housing here is dominated by row homes and rentals, just like Union Square.

[su_row][su_column]

Walkability & Transit Scores

[su_progress_bar percent=”77″ text=”Walkability Score – 77%” fill_color=”#67cb36″]

[su_progress_bar percent=”60″ text=”Transit Score – 60%” fill_color=”#f0ca1c”]

[/su_column][su_column]

Patterson Park Ratings:

| Housing | C+ |

| Public Schools | C- |

| Crime & Safety | C- |

| Cost of Living | B |

[/su_column][/su_row]

Pigtown

Median Home Price: $106,000

This neighborhood is known for its diverse residents; singles, couples, students, and retirees all call Pigtown home. The housing here is just as diverse, with a variety of condominiums, row homes, new construction, and rentals within walking distance of Pigtown’s 36-block historic district.

[su_row][su_column]

Walkability & Transit Scores

[su_progress_bar percent=”86″ text=”Walkability Score – 86%” fill_color=”#67cb36″]

[su_progress_bar percent=”72″ text=”Transit Score – 72%” fill_color=”#f0ca1c”]

[/su_column][su_column]

Pigtown Ratings

| Housing | C- |

| Public Schools | C- |

| Crime & Safety | D+ |

| Cost of Living | B- |

[/su_column][/su_row]

Highlandtown

Median Home Price: $251,741

Highlandtown has the highest home values on this list and its residents have a strong sense of neighborhood pride. The region has strong communities of Irish, German, Polish, Italian, and Latino immigrants who have developed an international local culture. Housing here is comprised of row homes, new construction, and rentals.

[su_row][su_column]

Walkability & Transit Scores

[su_progress_bar percent=”92″ text=”Walkability Score – 92%” fill_color=”#67cb36″]

[su_progress_bar percent=”61″ text=”Transit Score – 61%” fill_color=”#f0ca1c”]

[/su_column][su_column]

Highlandtown Ratings:

| Housing | C- |

| Public Schools | C- |

| Crime & Safety | C- |

| Cost of Living | B- |

[/su_column][/su_row]

The ABL Perspective

Many people disregard Baltimore due to its high crime rates, but there are significant opportunities for Baltimore investors. Not only is Baltimore the largest city in Maryland with a population of over 600,000, but the number of renters far exceed the number of homeowners. Understanding and investing in Baltimore would be an incredible way for a savvy investor to secure steady cash flow. Additionally, Johns Hopkins and Under Armour have invested millions of dollars in the city, so parts – if not all – of Baltimore are sure to increase in value and desirability in the coming years.

The key to success is to understand the city and the neighborhood you are investing in. Don’t buy properties all over the map; choose a specific area and work there until you understand it completely, block by block. Once you’ve reached that point, you can choose a new neighborhood to familiarize yourself with and expand your Baltimore investment possibilities.

Asset Based Lending specializes in hard money loans for Maryland real estate investments.

If you’re looking for an expert loan officer to help you fund your next investment project, call us at 201-942-9089 or pre-qualify online.

[su_spoiler title=”Sources” icon=”plus-circle”]

- Demographic data from Data USA.

- Trend data from Market Minute.

- Real estate data from NeighbourhoodScout.

- Market values from Zillow.

- Walkability and transit scores from Live Baltimore.

- City ratings from Niche.

*Walkability Score: Measures walkability based on distance to nearby destinations and pedestrian friendliness.

[/su_spoiler]

0 Comments