[su_note note_color=”#ffffff” text_color=”#282828″ radius=”0″]

Prince George’s Demographics

[su_row][su_column size=”1/5″][su_icon_panel icon=”icon: user” icon_color=”#095566″ icon_size=”50″]912,756 Population[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: suitcase” icon_color=”#095566″ icon_size=”50″]1.2% 1-Year Employment Growth[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: money” icon_color=”#095566″ icon_size=”50″]$81,240 Median Household Income[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: birthday-cake” icon_color=”#095566″ icon_size=”50″]Median Age: 37[/su_icon_panel][/su_column][su_column size=”1/5″][su_icon_panel icon=”icon: car” icon_color=”#095566″ icon_size=”50″]79% Commute By Car[/su_icon_panel][/su_column][/su_row][/su_note]

Another waterfront county in Maryland, Prince George’s is home to Six Flags America, the Capitol Wheel, and the Gaylord National Resort and Convention Center – not to mention a number of parks and gardens full of green hiking trails. The county also lays claim to the University of Maryland’s main campus in College Park, with more than 40,000 students.

Prince George’s County has treated our fix and flip investors very well recently; we’re seeing frequent purchases between $100,000 and $150,000, rehabs between $60,000 and $80,000, and sales between $250,000 and $300,000.

Our Maryland investors have seen some of the best returns in Temple Hills, Oxon Hill, Mount Rainier, and Fort Washington. The typical Prince George’s property is a 2 or 3 bedroom single-family rambler home. Most investments don’t require any heavy renovation to turn around, so it’s easy to fix, flip, and move on. Since there’s so little variation in home features and architecture – you’re really just going for curb appeal plus full kitchen and bath renovations – sale prices are predictable and rehabs are moving fast.[su_row][su_column size=”1/3″]

Prince George’s Real

Estate Trends

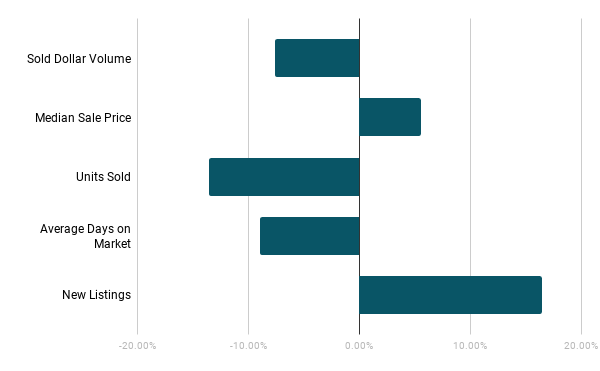

In Prince George’s County, two positive trends for sellers over the past year are that the median sale price has increased and the average days on the market has decreased. However, the decrease in units sold and sold dollar volume – especially when paired with the 16.5% increase in new listings – may be cause for concern for investors looking to sell freshly rehabbed properties in the coming months.[/su_column][su_column size=”2/3″]

Investing in Prince George’s Real Estate

[su_row][su_column size=”1/2″]

Because so many of the county’s homes are small-footprint, cookie cutter homes, Prince George’s is great for investors looking for quick, simple flips. Although there are a lot of upscale homes for sale in the region, most fix and flip investors are targeting lower-income buyers looking for a clean, simple, updated home in a decent area.

Right now, the Prince George’s real estate market heavily favors sellers. From January 2018 to January 2019, the average sale price increased 9% while the average days on market decreased 9%. Although there are still great deals out there, buying in Prince George’s County can be challenging, so we recommend utilizing a wholesaler to find a fix and flip investment property if you can’t afford to spend the necessary time scouring the market yourself.

Although Prince George’s median list and sale prices are around 1% lower than Maryland prices in general, the rental prices are 12% higher. This presents an advantageous environment for buy and hold investors, since the rental value of the property is greater than its sale value when compared to similar homes in other markets.

[/su_column][su_column size=”1/2″]

Country vs. State: Market Values

| Prince George’s | Maryland | |

| Median List Price | $319,900 | $325,000 |

| Median Sale Price | $284,300 | $290,000 |

| Medial List Price (per Sq. Ft.) | $188 | $189 |

| Rent Index | $2,038 | $1,804 |

| Rent List Price (per Sq. Ft.) | $1.49 | $1.33 |

[/su_column][/su_row][su_row][su_column size=”2/3″]

Schools in Prince George’s County

Prince George’s County has an overall C- grade for its public schools, scoring a C for teachers, a C for academics, and a C for health and safety – although the county does receive A marks for diversity and sports. However, there are many schools where students are far outperforming their peers from schools across both Maryland and the US.

Top Prince George’s Elementary Schools

1. Glenarden Woods Elementary School

Glenarden, MD

2. Dora Kennedy French Immersion School

Greenbelt, MD

→ See our Greenbelt, MD real estate profile below.

3. Heather Hills Elementary School

Bowie, MD

→ See our Bowie, MD real estate profile below.

4. Robert Goddard Montessori School

Seabrook, MD

5. Kenilworth Elementary School

Bowie, MD

→ See our Bowie, MD real estate profile below.

[/su_column][su_column size=”1/3″] [/su_column][/su_row]

[/su_column][/su_row]

Higher Education

Prince George’s County also boasts one of the top public US Universities – University of Maryland, College Park. With 59% of UMD-College Park students electing to live off campus, areas around the university may be prime opportunities for simple rehabs and a rental investment strategy.

Popular Prince George’s Cities For Real Estate Investors

Bowie, MD

Median Property Value: $364,737

[su_progress_bar percent=”68″ text=”Livability Score – 68″ fill_color=”#f0ca1c”]

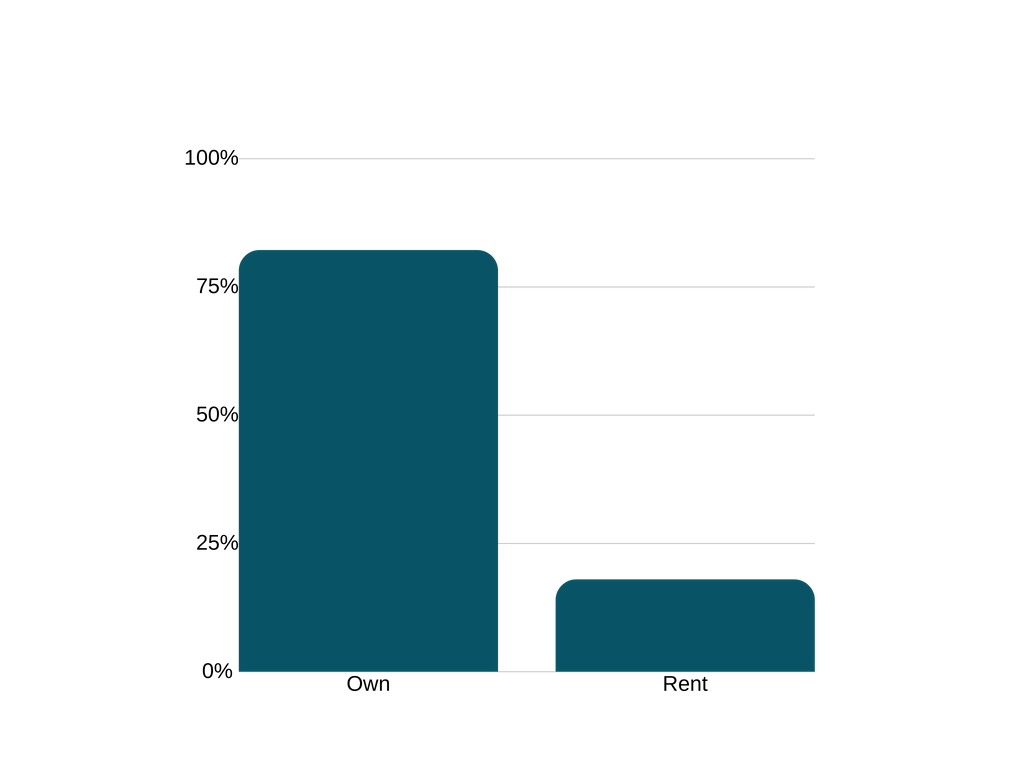

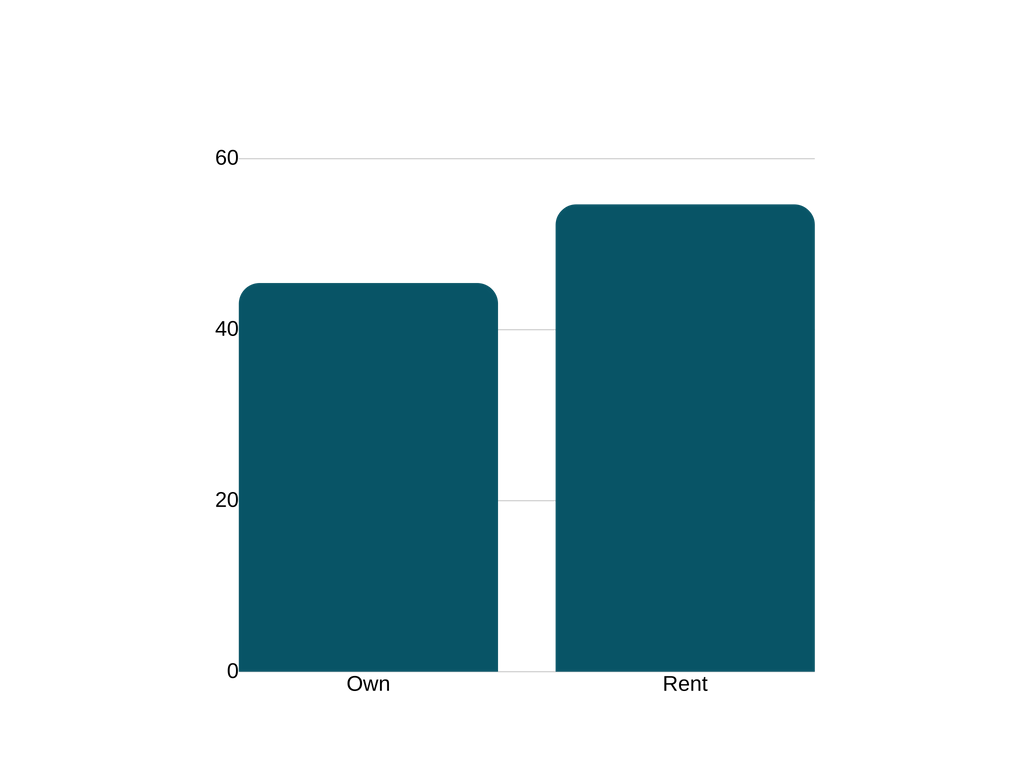

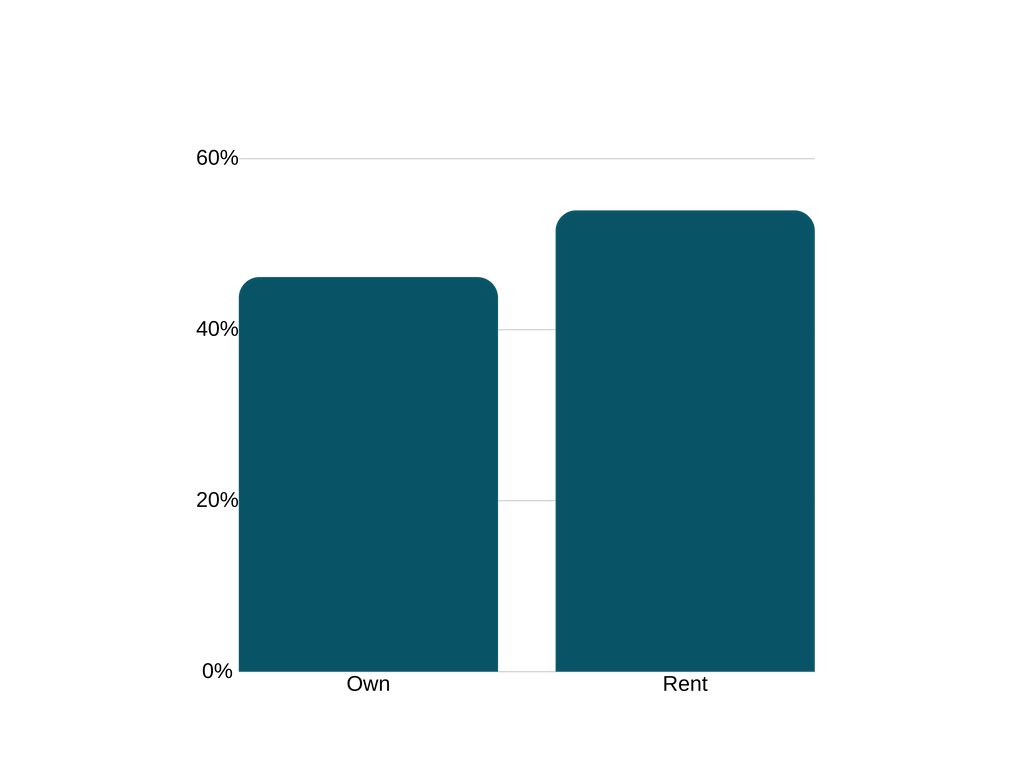

Far more Bowie residents own than rent, making this a prime location for fix and flip investors. With a median household income of over $100,000, buyers here can afford to spend more on high-end home finishes and won’t settle for anything less than the latest upgrades and the best neighborhoods.

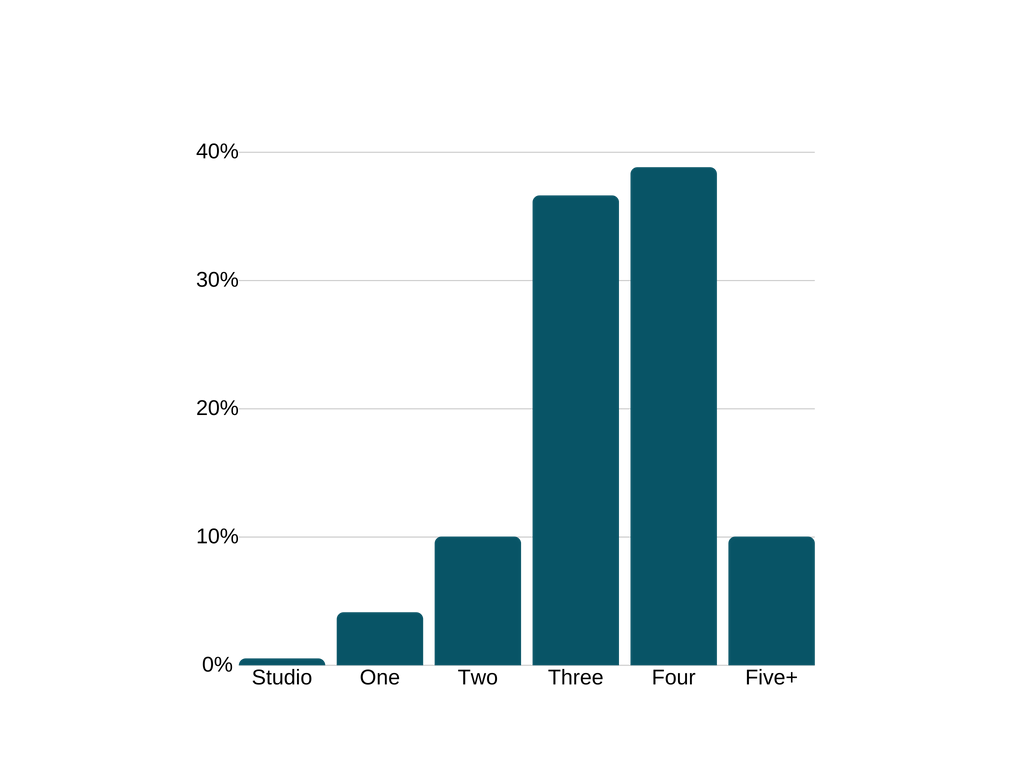

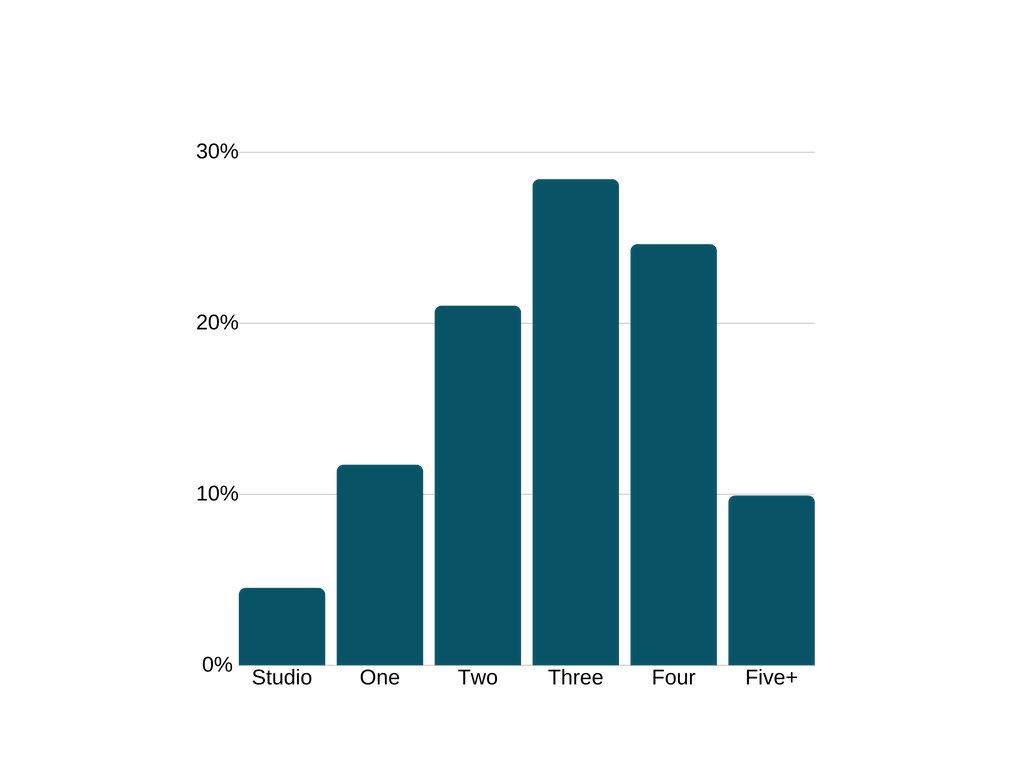

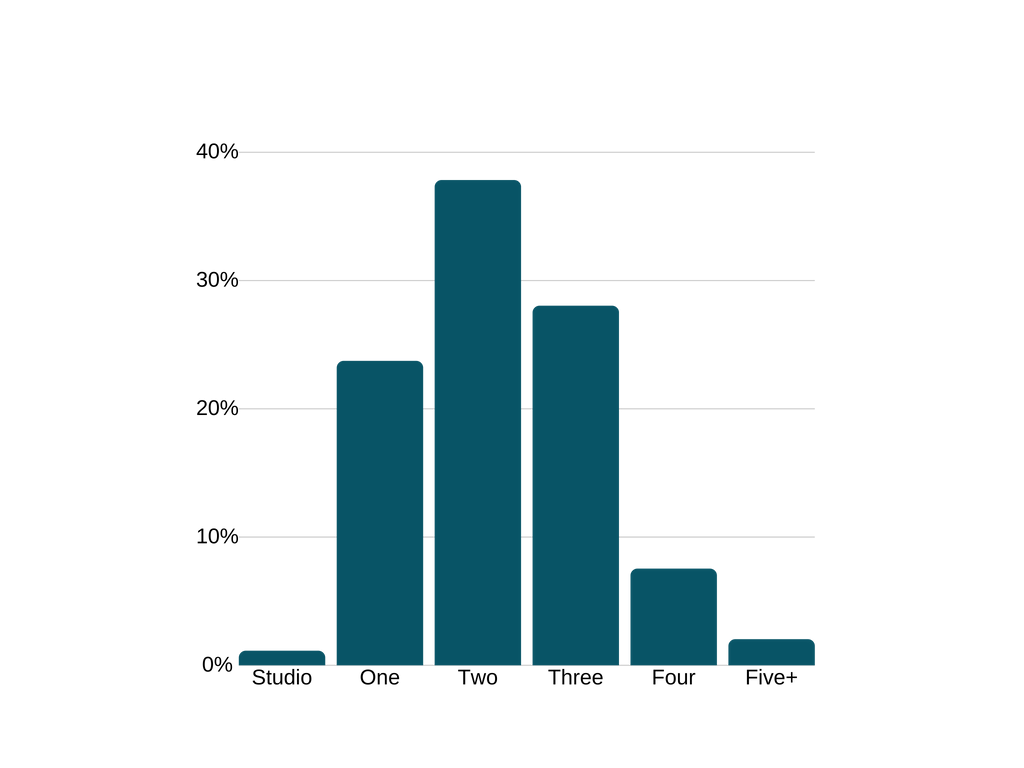

Homes here tend to be a bit larger than the rest of the county, with around ¾ of properties having either three or four beds. Although the homes here tend to sell at a higher price point than similar regions like Greenbelt or Laurel, buyers expect a corresponding increase in square footage. For middle-class or upper-middle-class buyers, you can expect your single family Bowie fix and flip to sell for around $400,000 to $500,000.

Bowie Real Estate Data

- Bowie Homeownership Data

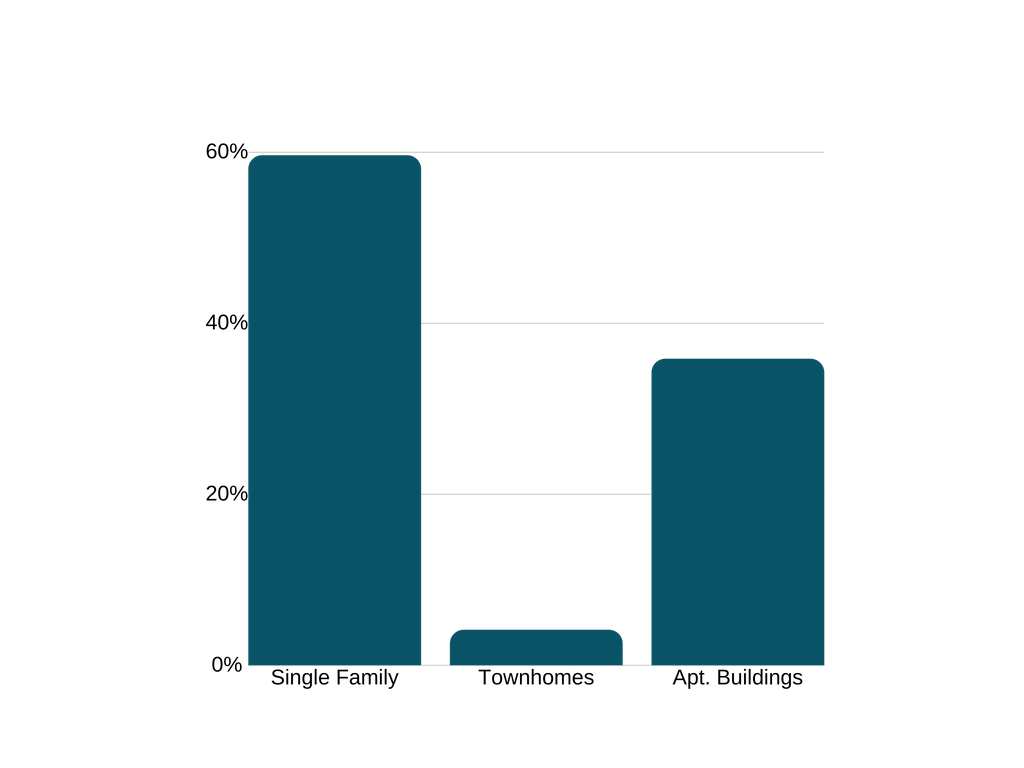

- Bowie Home Type Data

- Bowie Home Size Data

Return to city list.

College Park, MD

Median Property Value: $396,380

[su_progress_bar percent=”58″ text=”Livability Score – 58″ fill_color=”#f0ca1c”]

True to its name, College Park is a quintessential college town, with much of local real estate and culture revolving around University of Maryland students. Although the median household income is lower at $62,000, property values are still extremely high for Maryland since many of the city’s young residents have parents who are willing to help out with expenses – and rent payments.

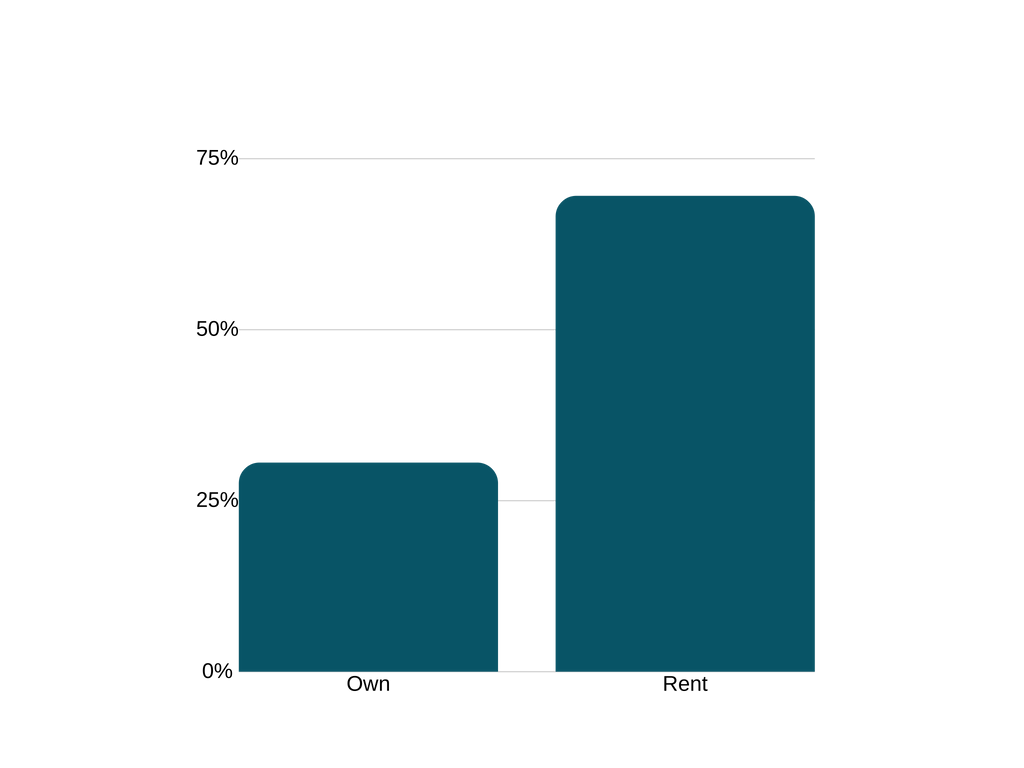

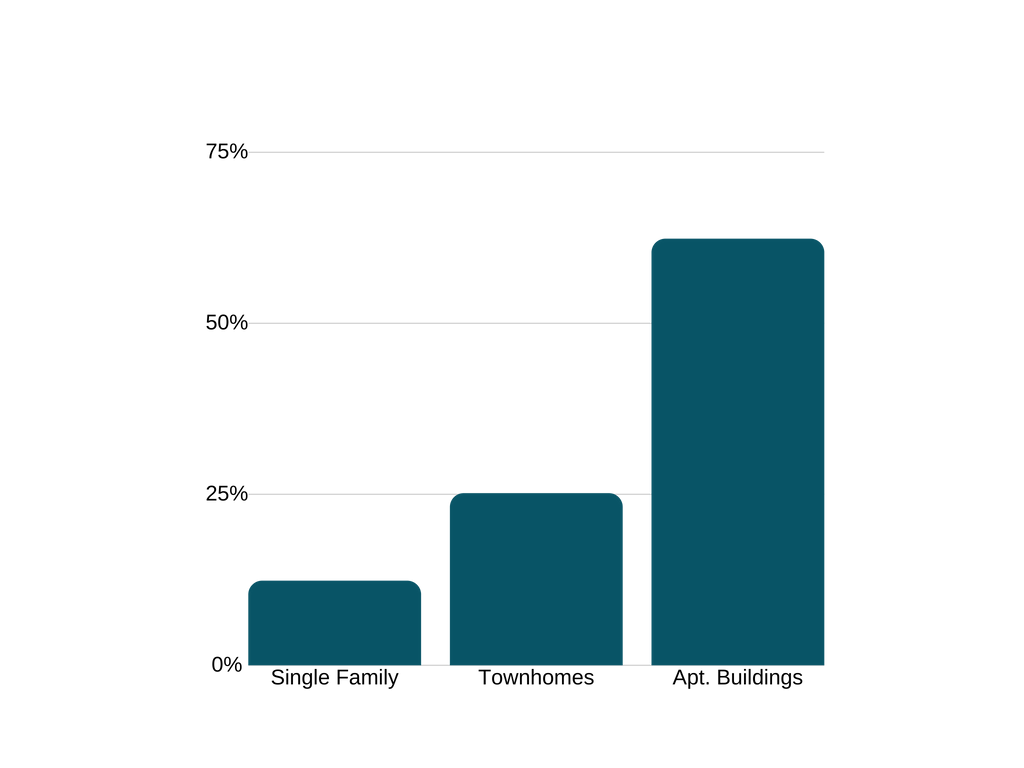

Here, more than twice as many people rent as own and more than 35% of College Park homes are either small apartment buildings or large apartment complexes. The average rent in College Park is $2,254 and the average apartment size is 942 square feet. If you invest in apartments around the university, keep your rent price in line with the local market, and take care of your tenants, you’ll have a steady stream of college students who will refer your rental to their friends when they graduate.

College Park Real Estate Data

- College Park Rental Data

- College Park Home Type Data

- College Park Home Size Data

Return to city list.

Greenbelt, MD

Median Property Value: $297,532

[su_progress_bar percent=”63″ text=”Livability Score – 63″ fill_color=”#f0ca1c”]

Greenbelt is similar in many ways to Bowie, but its property prices are lower than Bowie’s, with a median property value just under $300,000. Its residents are also slightly less wealthy – although by no means struggling – with an average median income of $72,800. Greenbelt is a good location for both fix and flips and rentals, with slightly more than half of residents renting rather than owning.

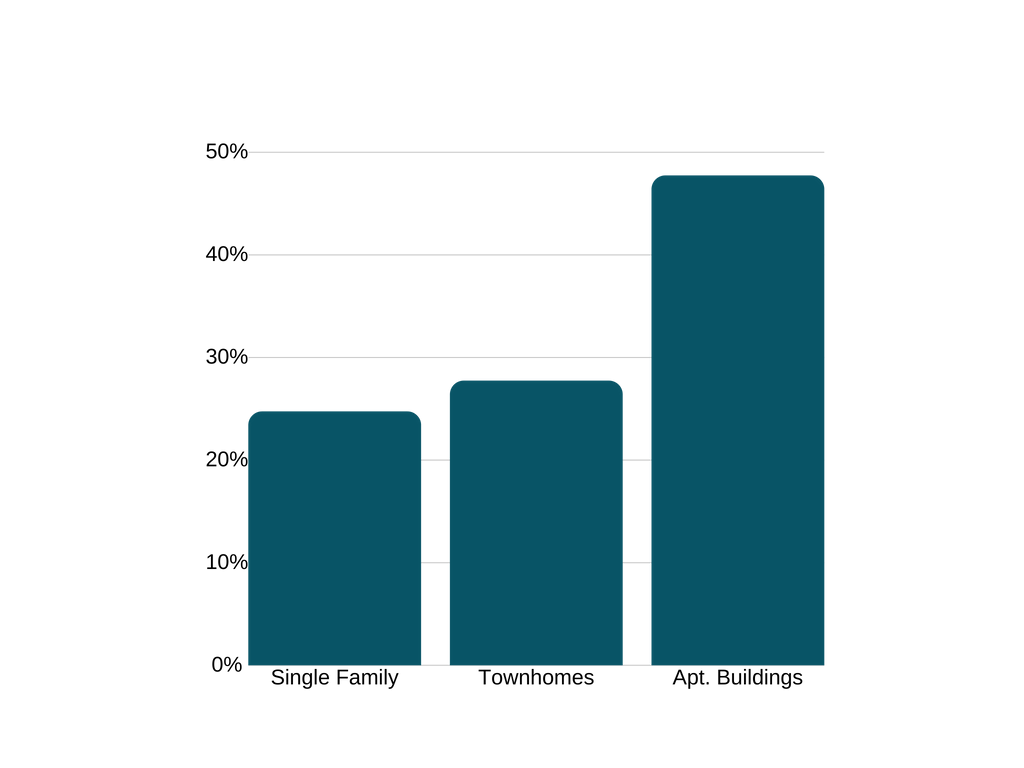

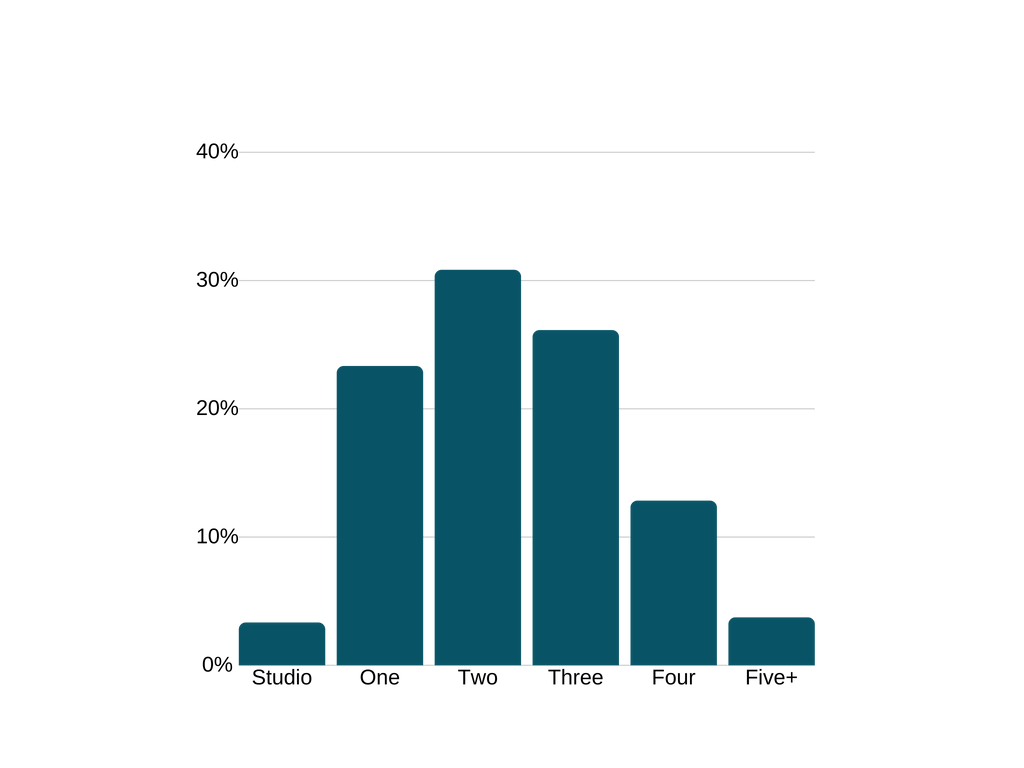

Homes in Greenbelt are on the smaller side; around 24% have one bed, 38% have two beds, and 28% have three beds. Less than 10% of Greenbelt properties have four or more beds, so fix and flip investors should avoid large homes to attract the largest number of potential buyers. More than half of homes in Greenbelt are apartment complexes, while about a quarter are town homes and around 12% are traditional single-family properties.

Greenbelt Real Estate Data

- Greenbelt Rental Data

- Greenbelt Home Type Data

- Greenbelt Home Size Data

Return to city list.

Laurel, MD

Median Property Value: $274,383

[su_progress_bar percent=”63″ text=”Livability Score – 63″ fill_color=”#f0ca1c”]

Laurel’s population resembles Greenbelt across population, income, age, commuting method – even Laurel’s property value is just $20,000 – or 6% – lower than Greenbelt’s. Slightly more residents rent than own in Laurel and more than 75% of houses have between one and three beds.

Half of Laurel properties are either single families or townhomes, so fix and flip investors struggling to choose between Greenbelt and Laurel may have an easier time finding investment properties in this suburb of DC.

Laurel Real Estate Data

- Laurel Rental Data

- Laurel Home Type Data

- Laurel Home Size Data

Return to city list.

Asset Based Lending specializes in hard money loans for Maryland real estate investments.

If you’re looking for an expert loan officer to help you fund your next investment project, call us at 201-942-9089 or pre-qualify online.

[su_row][su_column size=”1/3″][su_photo_panel photo=”https://www.abl1.net/wp-content/uploads/2019/06/Baltimore-Report-Cover-2.png” url=”https://www.abl1.net/blog/baltimore-real-estate-investing-report/”]Related: 2019 Baltimore Real Estate Investing Report[/su_photo_panel][/su_column][/su_row]

[su_spoiler title=”Sources” icon=”plus-circle”]

- Demographic data from Data USA.

- Trend data from Long and Foster.

- Real estate data from NeighbourhoodScout.

- Market values from Zillow.

- Livability scores from areavibes.

*Livability score combines ratings for amenities, cost of living, crime, education, employment, housing, and weather to evaluate the quality of an area in a single metric.

[/su_spoiler]

0 Comments