All successful real estate investments need a comprehensive research plan to determine the profitability of an area. Often times, areas of high investment are indicators of higher than average profitability.

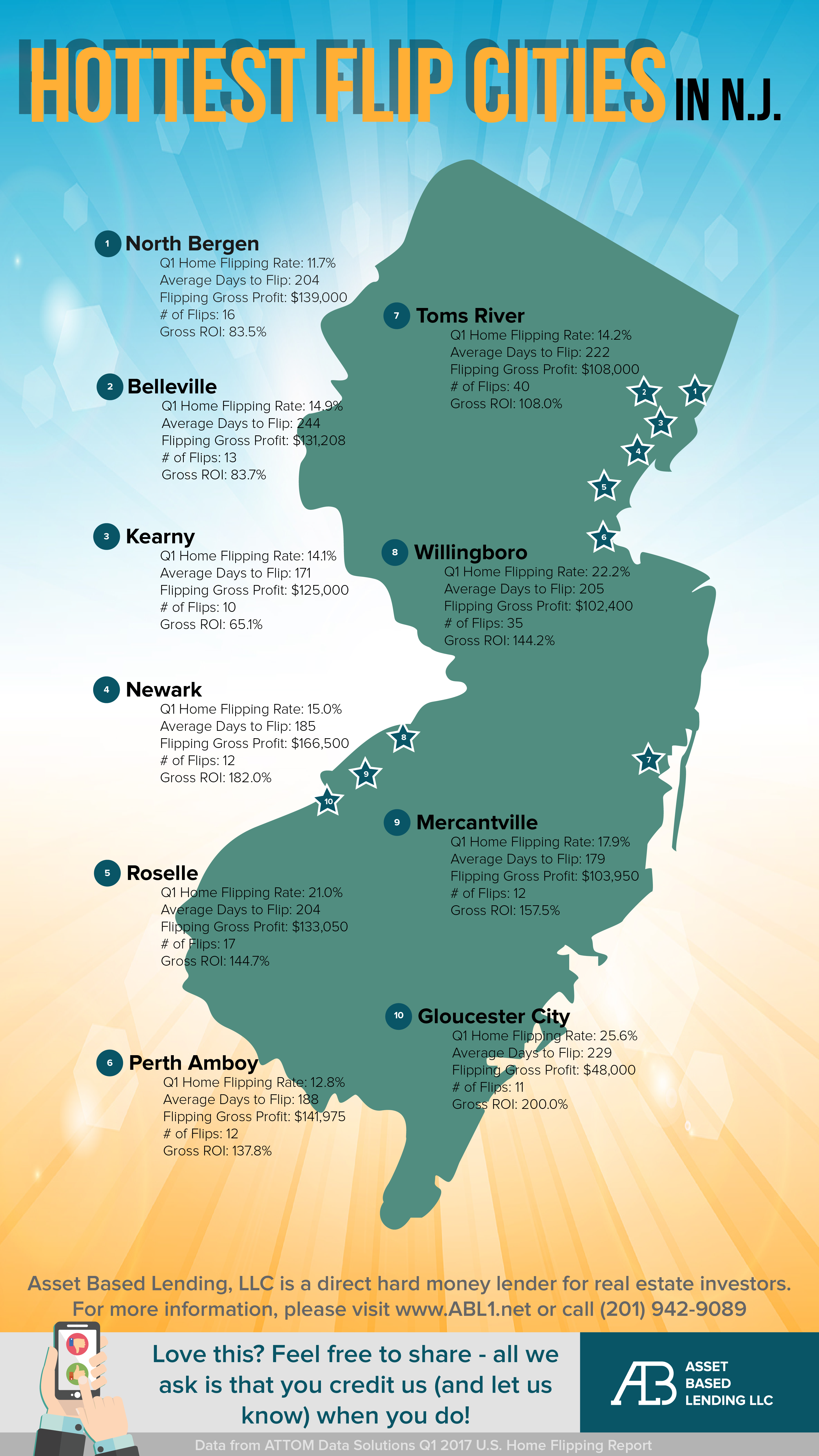

New Jersey’s fix and flip market is extremely active, so we’ve compiled a list of the top 10 hottest fix and flip cities and best house flipping markets in the state according to RealtyTrac data to help you determine the best spots to invest!

Our criteria is based on the Q1 Home Flipping Rate percentage of specific towns. NJ cities with the highest percentages had the most fix and flip sales relative to total real estate sales. Consider cashing in on these prime locations for your next deal!

#10: North Bergen, New Jersey

Located in Hudson County, North Bergen lands a spot on the list at number 10. North Bergen not only finds itself on statewide lists, but nationwide ones as well. Apart from being one of the most active fix and flip cities in the state, it is also the 96th most population dense city in the country. No wonder why flippers in the area earn an average profit of $139,000 per deal – there are a ton of people to sell to! (Fun Fact: our office is located in neighboring Hoboken, the 4th most population dense city in the world!)

- Zip Code: 07047

- Q1 Home Flipping Rate (Pct of Sales): 11.7%

- Avg. Days to Flip: 204

- Flipping Gross Profit: $139,000*

- Number of Flips: 16

- Gross ROI: 83.5%

#9: Perth Amboy, New Jersey

Middlesex County has been very friendly to home flippers in the past. Part of the success that the county has boasted in recent years is due to high investment activity in Perth Amboy: the city has been a hotbed for investors. Part of their accomplishments may be due to the ability for Perth Amboy investors to quickly advance through a deal, that is, how fast they can get in and out. The city flaunts an impressive flipping time frame averaging only 188 days. Savvy investors understand the vital importance of quickly selling their property. Failing to do so chips away at a deal’s profit margins. See the rest of the breakdown below:

- Zip Code: 08861

- Q1 Home Flipping Rate (Pct of Sales): 12.8%

- Avg. Days to Flip: 188

- Flipping Gross Profit: $141,975*

- Number of Flips: 12

- Gross ROI: 137.8%

#8: Kearny, New Jersey

Hudson County makes the list again! A suburb of neighboring Newark, New Jersey, Kearny is another active space for fix and flip investors. Sporting an even shorter flipping time frame than Perth Amboy, Kearny fix and flips take an average of only 171 days! Only 10 flips occurred in Kearny during the first quarter of 2017. Its relatively small number of flips in comparison to others on our list can be attributed to its smaller size and population. Despite its lower number of deals, Kearny is still a popular space for real estate investments.

- Zip Code: 07032

- Q1 Home Flipping Rate (Pct of Sales): 14.1%

- Avg. Days to Flip: 171

- Flipping Gross Profit: $125,000*

- Number of Flips: 10

- Gross ROI: 65.1%

#7: Toms River, New Jersey

Welcome Ocean County to the list! Toms River is one of the largest cities of New Jersey in our rankings, thus, its staggering 40 fix and flip deals completed in the first quarter of 2017. Keep in mind, with so much competition in Toms River, their turnover rate is slower, averaging 222 days. It’s important to evaluate these metrics, among others, to evaluate your property-specific strategy. Take a look at a fixer upper we recently funded in Toms River to get a better understanding of what a valuable property looks like in the area.

- Zip Code: 08757

- Q1 Home Flipping Rate (Pct of Sales): 14.2%

- Avg. Days to Flip: 222

- Flipping Gross Profit: $108,000*

- Number of Flips: 40

- Gross ROI: 108%

#6: Belleville, New Jersey

Don’t fear Belleville’s smaller size, this Essex county town presents a ton of value for potential real estate investors. Smack in the middle of our list, Belleville fix and flip projects comprise 15% of all town wide real estate sales. Belleville is nestled right off Garden State Parkway exit 149 and is only a short drive from the attractions of Montclair– potentially a reason for its growing popularity amongst investors. Here’s your full Belleville breakdown:

- Zip Code: 07109

- Q1 Home Flipping Rate (Pct of Sales): 14.9%

- Avg Days to Flip: 244

- Flipping Gross Profit: $131,208*

- Number of Flips: 13

- Gross ROI: 83.7%

#5: Newark, New Jersey

Just beating out Belleville, Essex County neighbor, Newark, is a nationally recognized city. It is home to one of the nation’s largest airports (EWR) and also a bustling fix and flip industry! Newark is transitioning through a resurgence; attracting popular retailers such as Whole Foods and Nike.

Many real estate investors are looking to get their foot in the door of this early resurrection, thus, Newark’s prominence on our list. Fix and Flip investors command an outstanding average return on investment (ROI) of 182%, the second highest percentage on our list! Highly profitable investors tend to capitalize on growing trends before the masses do. Smart investors seem to be reading the trends in New Jersey and profiting in Newark.

- Zip Code: 07107

- Q1 Home Flipping Rate (Pct of Sales): 15%

- Avg. Days to Flip:185

- Flipping Gross Profit: $166,500*

- Number of Flips: 12

- Gross ROI: 182%

[su_youtube_advanced url=”https://youtu.be/ru8VmJYW2D4″ width=”740″ height=”420″ controls=”alt” showinfo=”no” rel=”no” modestbranding=”yes”]

[su_button url=”https://www.abl1.net/casestudy/fix-and-flip-loan-in-newark-nj/” background=”#ffffff” color=”#508e81″ size=”4″ wide=”yes” center=”yes” radius=”0″ class=””]Check Out This Newark Fix & Flip Case Study[/su_button]

#4: Merchantville, New Jersey

Investors are able to flip their investments quickly in Merchantville, averaging only 179 days to do so. The smallest town on our list, Merchantville is located in Camden County and boasts a population of only 3,821. Still, it is extremely active in the flipping market with 12 flips happening in Q1 of 2017. Smaller areas like Merchantville might be perfect for newer investors unable to either personally fund their own projects or secure large enough loans to build in more popular areas. Median home value sits right at $162,000 and distressed properties are even cheaper! Every location provides different value to a unique investor and should be considered in a long term plan. Locations like Merchantville are ideal for starting small and working your way up to larger deals with more money on the line.

- Zip Code: 08109

- Q1 Home Flipping Rate (Pct of Sales): 17.9%

- Avg Days to Flip: 179

- Flipping Gross Profit: $103,950*

- Number of Flips: 12

- Gross ROI: 157.5%

#3: Roselle, New Jersey

Roselle represents Union County as its only member on our list. Neighboring nearby New Jersey cities, Elizabeth and Linden (also areas with high investment into real estate), Roselle’s real estate market is more than 20% accounted for by the fix and flip market. A quick look at the MLS foreclosure listings provides potential investors with a stockpile of viable real estate investments of foreclosures and distressed properties.

- Zip Code: 07203

- Q1 Home Flipping Rate (Pct of Sales): 21%

- Avg. Days to Flip: 204

- Flipping Gross Profit: $133,050*

- Number of Flips: 17

- Gross ROI: 144.7%

#2: Willingboro, New Jersey

Willingboro is another one of the smaller towns on our list right on the border of New Jersey and Pennsylvania. Only a short ride from metropolitan Philadelphia, part of the value investors find in this small town is rooted in its proximity to the 5th largest city in America. It’s no secret that location is arguably the single most important factor in determining the value of a potential property. There is immense value in up and coming locales developing around the hubs of activities, restaurants, and entertainment that the best cities in our nation offer. The fix and flip market is clearly strong in Willingboro. It stands out on our list as the city with the highest number of flips in the first quarter of 2017 with 35 completed!

- Zip Code: 08046

- Q1 Home Flipping Rate (Pct of Sales): 22.2%

- Avg Days to Flip: 205

- Flipping Gross Profit: $102,400*

- Number of Flips: 35

- Gross ROI: 144.2%

#1: Gloucester City, New Jersey

Fix and Flips dominate the market for real estate in this small Camden County city. Separated only by the Delaware River, Gloucester City is a quick trip away from Philadelphia on the Walt Whitman Bridge. It’s close proximity to the professional sports stadiums of Philidelphia (Phillies, Eagles and 76ers) may be of value to investors. Gloucester closes out our list as the hottest spot for flipping in New Jersey with an astounding return on investment of 200%! Gloucester City may be a home run for your next potential deal.

- Zip Code: 08030

- Q1 Home Flipping Rate (Pct of Sales): 25.6%

- Avg. Days to Flip: 229

- Flipping Gross Profit: $48,000*

- Number of Flips: 11

- Gross ROI: 200%

How did New Jersey fare overall?

In Q1 of 2017, New Jersey ranked fourth overall nationwide in home flipping ROI. It’s safe to say that New Jersey is both a popular and profitable location for real estate investments. The state provides a unique landscape for investors with a range of both experience and capabilities to fund projects. New investors just starting out can find experience in smaller, less expensive locales while still earning a profit. And more experienced investors with a greater ability to secure funding have larger and more expensive options with the promise of extremely high returns.

[su_note note_color=”#fefefe” text_color=”#818181″ radius=”0″]

*Gross profit was calculated by subtracting the median price for the first sale (purchase) from the median price of the second sale (flip) in each geography. Gross return on investment was calculated by dividing the gross profit by the median first sale (purchase) price. Gross profit and return on investment do not include property rehabilitation costs.

A flip was any transaction that occurred in the quarter where a previous sale on the same property had occurred within the last 12 months.[/su_note]

Ready to work with the best fix and flip lender in New Jersey?

Let’s get to work.

Pre-Qualify Today

0 Comments